After coming home from last year’s VMworld, I said this:

My overall impressions of VMworld were that VMware had one of the world’s largest stages to make some huge announcements, and it didn’t — instead, it showed incremental improvements. … Now it’s only a matter of waiting till next year to see whether VMware continues down that road of stability over major announcements.

The pattern has now become clearer: it’s about continuing a stable path for existing tech like vSphere while pushing the innovation toward new products like NSX (the evolution of Nicira’s software-defined networking product), vSAN, and vCloud Hybrid Service (vCHS). This pattern makes a lot of sense for the enterprise users that comprise the core of vSphere’s customer base, who care much more about stability than the latest bling.

But rather than rely too much on one analyst’s opinion, let’s take a look at some data. I performed an analysis of everyone tweeting about VMworld (tens of thousands of tweets, for the curious) to get a better sense of what VMware users cared about and what kinds of disconnects might exist between them and pundits — analysts, journalists, etc. Here, I’m going to focus on the keynote talks and look into how much practitioners and pundits cared about each of the topics and announcements during those sessions.

Day 1

The first morning started out slow, with acting CMO Robin Matlock coming up to talk about the 10th VMworld conference. She brought up a few of the 10-time attendees to talk about their highlights, which (predictably?) focused on parties and swag over talks. After that, new CEO Pat Gelsinger, announced at last year’s VMworld, came up on stage to sparse applause. He talked through a survey that the audience generally didn’t care too much about, and then got into the real content. To help evaluate the importance of that content, here’s a graph of the Twitter volume and sentiment throughout the keynote. I’m going to use this to target each of the peaks in volume or sentiment that I annotated at the top of the graph:

Gelsinger on stage: The CEO gets introduced and steps up on stage. Practitioners and pundits both announce this as the start of the “real” keynote.

Positive quotes: Gelsinger walked through a survey of VMware customers and cited a bunch of statistics in a favorable light, talking about customers as masters of the universe, ninjas, etc. Many people tweeted them using identical language.

Key pillars: He then described the underlying themes behind all of this year’s announcements, wrapped in the philosophies of “mobile-cloud era” and VMware’s now-old standby, the software-defined datacenter:

- Expand virtual compute to all apps

- Transform storage by aligning it with app demands

- Virtualize the network for speed and efficiency

- Automation: Management tools to define policies

Unsurprisingly, there’s a consistently high pundit volume throughout the positive quotes and the key pillars, while practitioners are much more subdued and want to get into the technical guts of the talk.

5.5 announced: The high point of the keynote for practitioners was the announcement of vSphere 5.5 (and vCloud Suite 5.5, in definitely parenthetical terms), with the following key features:

- 2x the number of cores, VMs (oops, 32x on disks: 64 TB max disk size — Audience excitement about this)

- Application-aware high availability (HA): monitor not just apps but components of apps

- Big Data extensions: scaling Hadoop clusters and sharing them

In this section, excitement centered around “64TB” disk images (apparently 62TB in actuality, but still 30x bigger than today’s 2TB). The trend within the 5.5 features was generally mirrored by the pundits in relative terms, although it was definitely not the section of the keynote they were most excited about. Secondary was the app-aware HA, while the audience seemed to perceive Hadoop as basically a fad of the day. For example:

Hadoop messaging. Big data checkbox. Check. #VMworld — Theron Conrey (@theronconrey) August 26, 2013

Of additional note is the announcement of Cloud Foundry on vSphere, to a subdued response from pundits and practitioners alike. This is likely due to a combination of factors such as the conference audience (very focused on ops, not developers) and the early state of the PaaS market. This audience mismatch could also partially explain the response to the Hadoop news.

vSAN announced: The first real surprise of the day, in terms of products rather than features, was vSAN — VMware’s entrant into the software-defined storage market. It’s a welcome addition to compete with both the top (e.g. EMC, NetApp) and bottom ends of the market (open-source options like Ceph, Gluster, and Swift), with the easy competitive advantage of “The best one to use with vSphere” and an expected GA in the first half of 2014. But if the pricing isn’t also intermediate, it’s going to run into serious issues. From practitioners, this got nearly as much buzz as the vSphere 64TB announcement and was the most positive peak of the day in terms of sentiment. On the pundit side, it outperformed vSphere 5.5, indicating a possible bias toward new technology rather than what’s useful today without major effort.

NSX announced: Martin Casado, CTO/cofounder of Nicira (acquired last year), announced VMware NSX, framing it as ESX for networks. Importantly, he took time to introduce the SDN concept, which is one familiar to cloud developers but perhaps less so to enterprise ops outside of the VLAN context. They brought up 3 customers to tell their stories running previous versions of the software: Ebay, GE, and Citi. Among practitioners, there was just as much excitement about this as vSAN. Pundits were quieter, perhaps because they’d been expecting this ever since the Nicira acquisition, but simultaneously the most excited about it. I see this as another example of how practitioners are more excited about “now” and pundits are more excited about potential for the future.

Virt > phys ports: Martin Casado showed an interesting graph of the growth of physical and virtual ports over time. Although I’m unsure of its data source, here it is:  As you can see, there’s a crossover point in 2012 where the number of virtual ports exceeded the number of physical ports. Gelsinger had just previously cited 2010 as a similar crossover point for the number of machine instances that were virtual versus bare metal to underscore the importance of this graph, which is surprisingly accurate, considering it goes all the way out to 2015.

As you can see, there’s a crossover point in 2012 where the number of virtual ports exceeded the number of physical ports. Gelsinger had just previously cited 2010 as a similar crossover point for the number of machine instances that were virtual versus bare metal to underscore the importance of this graph, which is surprisingly accurate, considering it goes all the way out to 2015.

GA, no Cisco: The GA date for NSX was announced as 4Q2013, and numerous people among both practitioners and pundits noted that Cisco was conspicuously absent from the partners slide.

vCHS announced: The GA of their vCloud Hybrid Service (vCHS) was announced by Bill Fathers, SVP & GM, Hybrid Cloud Services. It will, as the name suggests, be a VMware-hosted cloud designed to integrate with private clouds. Services of note include Cloud Foundry, Disaster Recovery as a Service, and Desktop as a Service. It’s launching with 2 datacenters and will add 2 more this fall, plus another 2 via a Savvis partnership — all US-based. This got a spurt of activity out of practitioners, but far less than the on-prem products.

DRaaS with vCHS: Showing the importance of traditional on-ramps to cloud like backup and disaster recovery (DR), the announcement of DR as a service (DRaaS) on vCHS got just as much buzz as the announcement of vCHS itself. It will use vCHS as a new backend to VMware’s existing Site Recovery Manager product. Practitioners and pundits both got excited about this news, with clear bumps in sentiment and activity visible for both groups.

Day 2

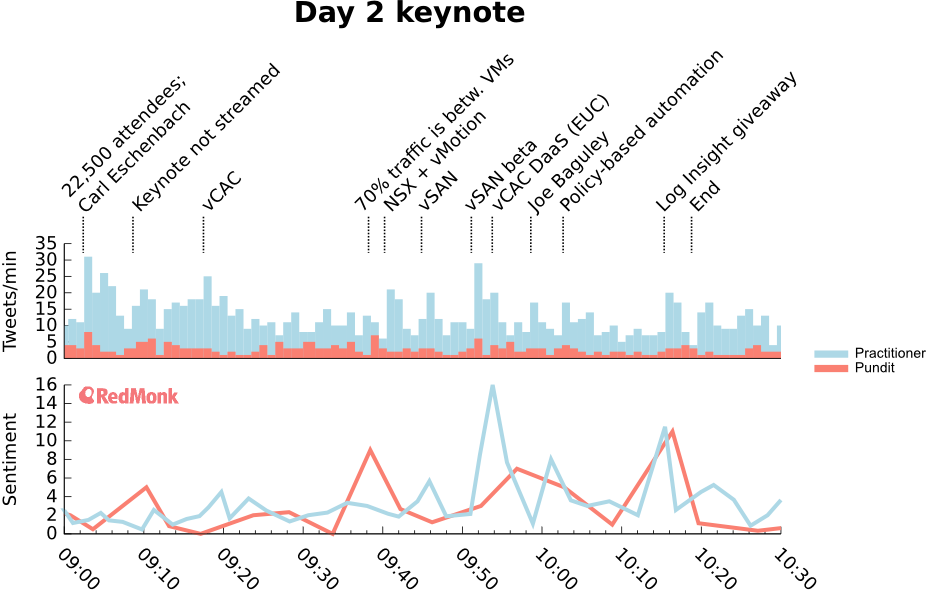

The keynote opened up with President and COO Carl Eschenbach coming up on stage to talk about the conference itself and rehash yesterday’s news, followed by a dive into the products mentioned yesterday, in the form of a skit between Eschenbach and principal engineer Kit Colbert. Again, we’ll do a visualization and walk-through of the highlights of our practitioners and pundits:

22,500 attendees; Carl Eschenbach: Some opening stats, everyone likes to hear how many people there are who, like themselves, came to the show.

Keynote not streamed: After 10 minutes, it seems like most of the online viewers of Day 1 figured out that Day 2 would not be streamed. This was a particularly strange choice by VMware because attendees have historically enjoyed day 2 more than day 1.

vCAC: This was the start of the skit/demo between Eschenbach and Colbert, which walked through vCAC, App Director, NSX, and vSAN.

70% traffic is betw. VMs: Colbert said that up to 70% of traffic in the datacenter is just between VMs. This got a big sentiment and traffic spike from pundits but relatively little from practitioners. Chances are it’s not news to them since they see it every day in their monitoring.

NSX + vMotion: They showed that vMotion, which moves VMs from one physical host to another, will integrate with virtual networks to migrate the networking as well. Practitioners were extremely interested, but pundits didn’t show much of a response at all.

vSAN: While pundits showed little enthusiasm, the demo of vSAN got practitioners very excited. They were particularly intrigued by the apparent ease of use.

vSAN beta: Again, practitioners were active and excited about the vSAN beta, while pundits were largely absent. However, there were questions about enterprise readiness regarding scalability and data safety, particularly in the event of failures.

vCAC DaaS (EUC): This was a demo of provisioning an end-user desktop with the vCloud Automation Center, dubbed Desktop as a Service (DaaS). It was the only real focus on end-user computing (EUC) during any of the keynotes.

Joe Baguley: VMware’s CTO for EMEA stepped up on stage.

Policy-based automation: First came the demonstration of auto scale-out via new vCAC + vCOPS (vCloud Operations Manager) integration. Then Baguley made the case that scripting is fragile and so we should rely on policy instead. Key quote: “Scripts are just a posh way of saying manual.”

Log Insight giveaway: VMware announced that every VMworld attendee would get 5 free licenses to its new Log Insight product, which is directly competing with (most obviously) Splunk as well as newer entrants like Sumo Logic and IBM. Unsurprisingly this produced a huge spike in both traffic and sentiment, with more interest from practitioners than pundits since they’ll be the ones actually using the software.

Practitioners versus pundits

This emphasizes a key difference between practitioners and pundits: what’s practical and tangible today vs where the new innovations are. Practitioners cared most about the technical details of updates, as well as things directly bordering on areas they work in and problems they have (vSAN). Today’s VMware customers are conservative — they don’t care a whole lot about SDN or the cloud, whether it’s in the form of vCHS or OpenStack. A mention of OpenStack as a supported vCAC provisioning target, just after the NSX GA announcement, on day 1, maintained interest but showed no spike in activity or sentiment among practitioners, although it did show an upward trend among pundits.

Rational does not make right

With the divestment of the somewhat tangential Pivotal assets (SpringSource and Cloud Foundry, among others), VMware has enhanced its focus on its original core of virtualization and is now extending that to storage and networks. Its direction seems to be much more rational and logical at this point, which is encouraging because not many companies can manage products across such a broad array of areas successfully. SocialCast seems to be a weird remnant that I’d expected to go to Pivotal, and I’m waiting to see what comes of that now that Sanjay Poonen has moved over from a high-level position at SAP to run VMware’s end-user computing efforts. VMware’s profit for the past two years combined was below $1.5 billion (and that’s prior to the Pivotal handoff). That number is not much greater than the $1.2 billion purchase price of Nicira, indicating the seriousness of VMware’s future commitment to SDN.

However, a rational product lineup doesn’t mean it’s the right product lineup for today’s market. Everyone’s banging on how vCHS is terrible in large part because it’s not Amazon. But there’s always going to be a place in every market for a full-service offering. [See our 2007 writeup predicting a VMware cloud.] However, Amazon’s clearly working on improving its enterprise offerings, as evidenced by analyst sessions at last fall’s Re:invent conference, plenty of webinars (you should see my inbox), and instances like its hire of former sales chief Mike Clayville away from VMware.

Disruption tends to come from below, and VMware’s biggest concern (not to mention IBM’s) should not be Amazon in its present form as DIY cloud, but rather Amazon succeeding in bringing its low-margin expertise to higher-touch enterprise audiences. And between clones of the AWS API in any number of IaaS stacks, and Amazon’s own moves in the private cloud sector like winning battles against IBM to build a cloud for the CIA, certainly the hosted aspect of VMware’s hybrid cloud is facing serious, even existential, challenges.

And that’s before we even get into the challenges hybrid cloud faces with data gravity [here’s one of our writeups]. Shifting data back and forth between public and private instances depends on pipes of limited bandwidth. And if you get into synchronizing distributed systems, you’re faced with yet another set of challenges for which VMware has little answer today — its in-memory options of SQLFire/GemFire/Redis are not always the right tool.

That said, the strategy of providing identical containers on-prem and in the public cloud is clearly a good one, as evidenced by the recent emergence of tools and companies such as Docker and Ravello. Unfortunately VMware’s story today appears to be about migration rather than about dev/test and DevOps workflows. This is strange, because migrating heavyweight VMs back and forth between private and public environments is hard-hit by data gravity. I would argue that it’s a failure on VMware’s part to appeal to its new developer audience, because it’s got a long history of working with and understanding sysadmins. Not only that, but it’s recently handed off (to Pivotal) or lost pretty much every group with a deep understanding of what developers want, Salvatore of Redis fame notwithstanding.

Don’t alienate your audience

VMware’s announcement of NSX garnered a great deal of attention and excitement from VMworld attendees, but not all of it was positive. In much the same way as companies making a DevOps transition should avoid making enemies of the ops or DBAs but rather recruit them to new roles, a shift toward SDN should avoid alienating network admins but rather bring them into the fold. VMware today appears to be failing at this:

Looking at all the #vmworld tweets and info on various blogs surrounding #vmwnsx almost sounds like #VMW is trying to alienate net admins. — Christopher Bell (@brotherbell) August 27, 2013

I still don’t see the traditional net eng adopting #nsx anytime soon. Nsx seems like a way around the hurdle of dealing with them. #VMworld — Mike Baranski (@mikebaranski) August 27, 2013

Alienating those who could be your most ardent supporters seems like a foolish move, but maybe that’s just me.

Disclosure: VMware, Pivotal, Cisco, Splunk, IBM, Red Hat (which acquired Gluster), and Ravello Systems are clients, as are a number of cloud vendors including Amazon, Cloudscaling, Citrix, Joyent, and Rackspace. EMC (primary owner of both VMware and Pivotal), Inktank (which sells Ceph), SwiftStack, Sumo Logic, Savvis, and dotCloud are not.

No Comments