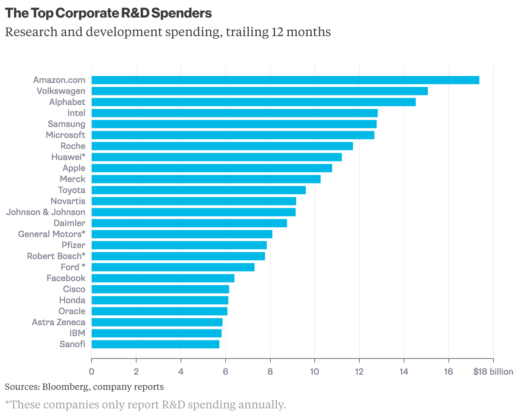

A June 2017 Bloomberg analysis of top global R&D spending found “Amazon.com Inc. passed Volkswagen AG late last year to become the world’s biggest corporate spender on research and development.”

Image source: Bloomberg

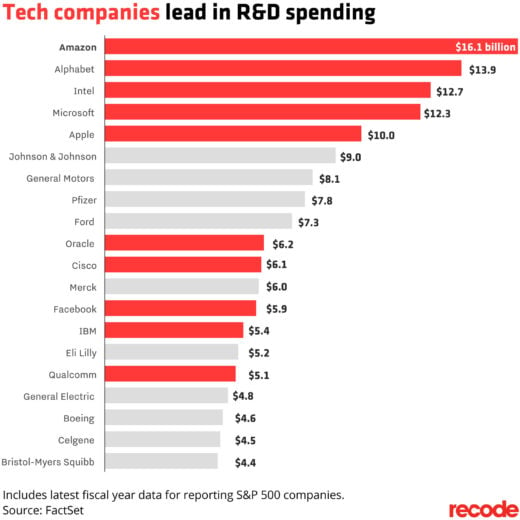

In September 2017 Recode published a similar analysis comparing research and development (R&D) spending across U.S.-based companies. The top five U.S.-based R&D spenders in FY2016 were all tech companies, led by Amazon with $16.1B in R&D expense. Recode asserted this is “a figure that should strike fear into its competitors.”

Image source: Recode

These headlines caught our eye, and we were curious: just how fear-inducing should Amazon’s R&D spending be, specifically for other cloud providers? After all, Alphabet (parent company of Google), Microsoft, Oracle, and IBM are also reflected in these lists of top R&D spenders. Are there any telling R&D trends amongst this group that helps reveal their competitive positioning?

Caveats

- The below analysis is confined to U.S.-based cloud providers Amazon, Alphabet, Microsoft, Oracle, and IBM. Our past analysis of cloud infrastructure included players that we are excluding here: CenturyLink does not provide a breakout of R&D numbers, Rackspace has since gone private, and HPE has stopped competing in public cloud.

-

There are some fairly significant caveats to using publicly available financial data for this analysis. The most notable is that all of these companies have other major lines of business that obfuscate the impact of their cloud strategy in their consolidated financial statements. We do not claim that R&D numbers below are exclusively related to cloud, nor to we assert that the totality (or even majority) of a company’s cloud development spending is captured in their R&D.

R&D by Cloud Providers

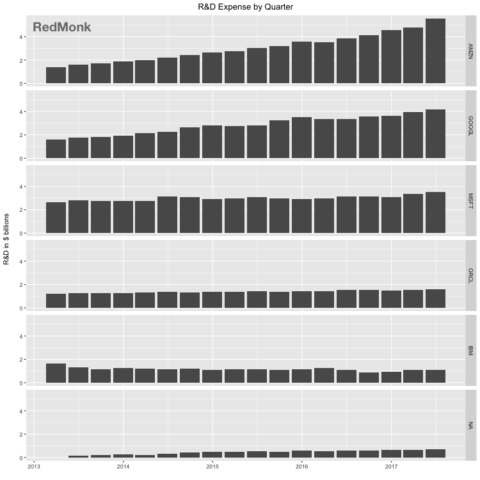

The above charts show R&D spending for the prior fiscal year, but how has that evolved over time?

A few observations:

- In early 2013, Microsoft lead the group in R&D spending, followed by IBM, Google, Amazon, and Oracle. As of mid-2017, that shifted to Amazon, Google, and Microsoft all significantly outspending Oracle and IBM.

- Amazon’s growth in R&D has significantly outpaced their peers, with their last quarter 2017’s R&D spending over 300% of what it was in early 2013. Google increased their quarterly investment in R&D by just over 150%. Microsoft and Oracle increased marginally, while IBM’s absolute dollars spent on R&D have declined since 2013.

- Perhaps unsurprising, but the companies that have the highest increase in R&D spending (Amazon and Google) also have the most variety in their product lines. From making original video content to self-driving cars, both Amazon and Google have experimental business units that contribute to their R&D spend.

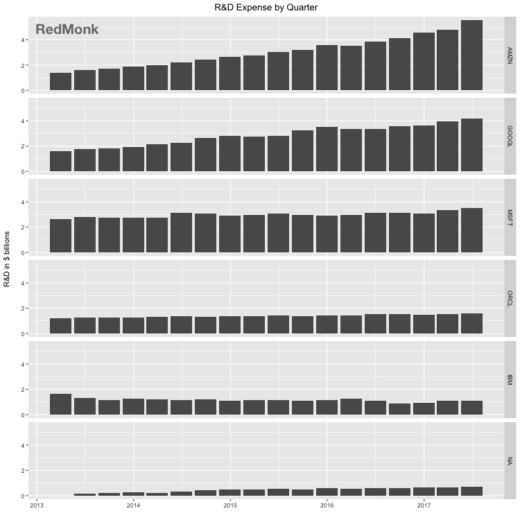

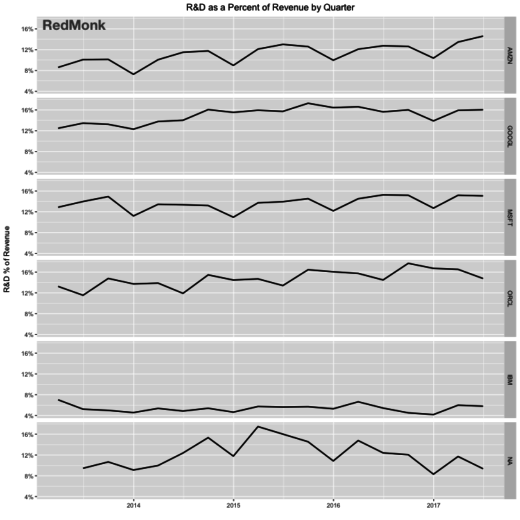

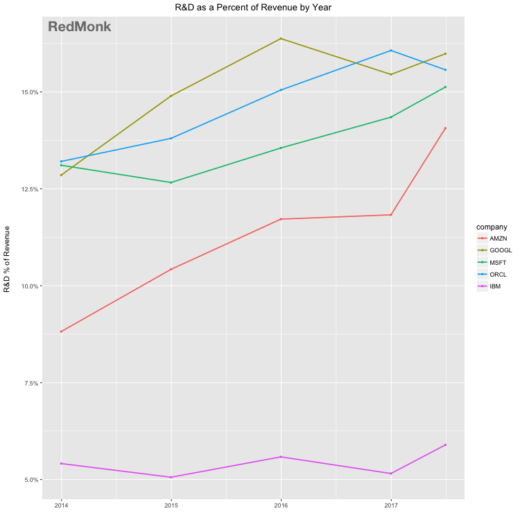

Since raw dollars can obfuscate the relative size of the investment, let’s also examine R&D as a percentage of revenue.

There is some noise in these figures due to seasonality of revenue, so let’s look at that on an annual basis.

A few observations:

- When viewed as a percentage of revenue, Google becomes the leader in proportionate R&D spending, followed by Oracle, Microsoft, Amazon, and IBM.

- As in absolute dollars above, Amazon continues to show the most consistent increase in R&D spending as a portion of their total revenue from 2013 to 2017.

- When viewed in raw dollars, the data seemed to show an obvious gap between the players widely acknowledged to be top-tier cloud providers (Amazon, Microsoft, and Google) and their competitors. When viewed on a percentage of revenue basis, however, the connection between R&D spending and competitive positioning seems less correlated.

Conclusions

While the trends are interesting, I’m not convinced there is anything particularly telling in this data.

Unlike our 2016 PP&E analysis, it’s much more difficult to make any inferences that consolidated R&D spending is reflective of a company’s investment specifically in their cloud business. I continue to believe that commitment to cloud is better reflected by PP&E than R&D.

Similarly, we’ve previously explored how research and development spending is not equivalent to innovating. The Bloomberg article about Amazon’s R&D spend concludes:

“What does this ranking signify? In terms of future corporate performance, not much. The consulting firm Strategy& has been tracking R&D spending for more than a decade and found that the top-10 R&D spenders actually underperform their industry peers.”

Research indicates that R&D is weakly correlated to a company’s future success. While investing in R&D is undoubtedly a part of Amazon’s playbook, it is one of a myriad of factors contributing to their competitive dominance (in cloud or other competitive categories.) While Recode asserts that Amazon’s R&D should be alarming to competitors, I would argue that R&D spending alone is not the source of concern.

Disclaimer: Amazon, Google, Microsoft, Oracle, IBM, and CenturyLink are all RedMonk clients.

* A quick note about IBM: Sharp-eyed readers may have noticed that Bloomberg, Recode, and RedMonk all have slightly different numbers for IBM’s R&D; it turns out there are a surprising number of valid R&D numbers available for IBM. Bloomberg uses “total consolidated research, development, and engineering”, while Recode’s data source, FactSet, takes a subset of that number confined to “scientific research and the application of scientific advances to the development of new and improved products and their uses, as well as services and their application.” Our source for financial data, ycharts, appears to use IBM’s total R&D net of “intellectual property and custom development income.” For the purposes of this analysis, we found the differences to be negligible, but we invite readers who prefer a specific R&D interpretation to adjust the data accordingly.

Don't take Oracle's cloud-superiority claims too seriously | MASIEV Tec. says:

October 6, 2017 at 4:12 am

[…] cloud providers—AWS, Microsoft Azure, and Google Cloud Platform—are making. As Redmonk analyst Rachel Stephens has noted, “The companies that have the highest increase in R&D spending (Amazon and Google) also have […]

Don't take Oracle's cloud-superiority claims too seriously | InetServices says:

October 6, 2017 at 8:32 pm

[…] cloud providers—AWS, Microsoft Azure, and Google Cloud Platform—are making. As Redmonk analyst Rachel Stephens has noted, “The companies that have the highest increase in R&D spending (Amazon and Google) also have […]

Phil says:

October 25, 2017 at 4:23 am

I’d like to highlight that Amazon and AWS are not the same thing yet the two seem to be completely intermixed in this analysis of R&D. Amazon is a retailer, an online bookstore, it sells video/music downloads/streaming like Netflix, and produces consumer electronics like Kindle e-readers, Fire tablets, Fire TV, Echo, etc. There is no way that the total R&D spend of Amazon is associated to AWS the Cloud Business and is Amazons Cloud as well and should not be counted as “Cloud R&D”! What % of Amazon R&D actually goes to AWS Cloud for consumers and not for Amazon business? A very interesting question that’s impossible to answer and therefore misleads all analysis!

Same for Google R&D where there is significant spend on Autonomous Cars, Android, Ad Search, Google Pixel and other electronics devices, etc. How much of Google R&D goes to Cloud (for customers) is yet another good question!

And even Microsoft R&D going to Xbox, Windows, Office and many other businesses which have little to do with Cloud.

Then you look at Oracle R&D. Appears that a majority of R&D is going to Cloud, from the Database, applications, middleware to its hardware, all being developed to drive its cloud business. It doesn’t have side businesses that divert R&D spend like the others yet no one seems to bring this up?

Rachel Stephens says:

January 16, 2018 at 12:12 pm

Hi Phil,

100% agree, thus caveat #2 in the post. As outsiders we don’t have insight into where and how R&D dollars are being spent across lines of business. The limitations of publicly available financial data mean there are inherent limits on what we can conclude definitively, but I would assert that there is still value in looking at high level spending trends across a competitive set.