Commentary on some of the interesting numbers in the news

(Photo credit: Flickr/morebyless under CC-BY 2.0)

$20.2B

IBM reported a quarterly revenue of $20.2B. While that number was above the Wall Street estimate, it also represents their 17th consecutive quarter of year-over-year revenue decline. These results come within the challenging context of repositioning the 105-year old company to “become a cognitive solutions and cloud platform company.”

IBM’s 12% revenue growth in the ‘Strategic Imperatives’ segments indicates they have some traction with their transition. In the trailing 12 months, this area “delivered $31 billion in revenue, and now represents 38% of IBM” revenue. The crucial question, however, is less about their quarterly performance and instead about their long-term positioning: is IBM pivoting to the right strategy?

A couple of recent a16z podcasts shed some light on IBM’s direction. In the May 10, 2016 episode “On Corporate Venturing & Setting Up ‘Innovation Outposts’ in the Valley” Evangelos Simoudis spoke about Watson. “IBM is trying to make artificial intelligence extremely easy by encapsulating it in this platform, so that any application developer through a series of APIs can get access to all of that intelligence.” He described this as IBM’s ‘moonshot’ and stated “this is a very hard problem, and that’s why it needs the proper experimentation, the proper patience, and the proper personnel.” Simoudis’ overall stance about IBM’s ability to innovate was bullish, and his statements lend support to the company’s transition timeline.

In the July 10, 2016 podcast “Software Programs the World,” Marc Andreessen and Ben Horowitz discussed the emerging trends they view in the industry. They talked about the broad opportunity for AI to be “an entirely new way to write a computer program.” Here were some of their AI thoughts relevant to IBM:

- “The data set matters.” It will be difficult to compete with companies like Google or Facebook that have large data sets at their disposal, but there are also areas where data sets don’t exist yet. Two examples cited are healthcare and autonomy. From this perspective, IBM seems to be positioning itself well with Watson Health.

-

Because of the need to invest in engineers, hardware, and datasets, AI is generally seen as being the purview of big companies. However, this is changing as technologies standardize, move to open source, and go to cloud; these democratizing trends all benefit startups and smaller companies trying to move into the space. Andreessen predicts all major cloud providers will eventually provide AI-as-a-service.

On one hand, this validates IBM’s cognitive and cloud strategy choices. However, it may prove to be challenging for IBM as the space becomes more open and more competitive. The company will face competition both from startups that have new access to AI tools as well competition from the dominant cloud providers that already have a more established foothold than IBM in the infrastructure space.

From these perspectives IBM seems to be moving in the right direction. However, the overall market is moving there as well. I’m interested to watch how IBM continues to execute in the AI and cloud businesses relative to their competitors.

$85.3B

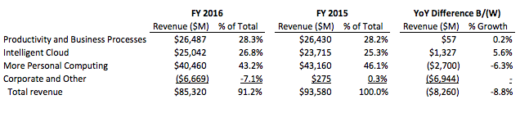

Microsoft closed their fiscal year with $85.3B in revenue and $16.8B in net income. The revenue breakdown by segment was as follows:

Full year revenue is down 9% from FY 2015, primarily due to the Corporate and Other segment. As I can’t be the only one who saw that and wondered how that segment’s revenue was negative, it seems worthy of a quick aside to explore that line item.

Warning: here comes accounting. “Corporate and Other revenue primarily comprises certain revenue deferrals,” as beginning in FY 2016 Microsoft changed their Device and Consumer licensing model for Windows 10. This means that the company can no longer recognize all their licensing revenue up front; instead the license revenue is booked in its entirety in the More Personal Computing segment and the deferred revenue is backed out in the Corporate and Other segment. Thus the negative value in the Corporate and Other line is primarily an offset to the licensing revenue in the More Personal Computing line. (I would like to send a serious shout out to the kind soul who authored this explanation of the revenue change; you are a hero to all of the nerds out there searching for ‘Windows 10 ratable revenue recognition.’)

Also of note is the year-over-year growth in the Intelligent Cloud segment’s revenue both in terms of absolute dollars and in terms of its percentage of total revenue. While the earnings release documents don’t break out Azure’s performance individually from the rest of the segment, the executive team provided the following color about their cloud services on the earnings release call:

- Growth: Azure quarterly revenue and usage grew by more than 100%.

- Open source: Nearly a third of customer virtual machines on Azure are running Linux.

- Customer mix: Roughly one-third of Azure’s revenue is generated by independent software vendors. Being able to sell alongside ISVs helps by “making them [ISVs] successful and thereby helping us [Microsoft] build very important scale through the platform.”

- Profitability: Microsoft’s executive team previously indicated they eventually expect Azure’s gross profit margin to match that of Amazon Web Services. As a point of reference, last quarter AWS’ operating margin was 23.5%. When asked about progress on that front CFO Amy Hood commented, “I think I have a strong line of sight to AWS’s margin profile and still feel good about the progress we’re making.”

While that measured response on current margins may not be overly inspiring, a Merrill Lynch report from May 2016 provided the following opinion on Azure’s profitability:

With Azure currently at a -10 to -20% incremental gross margin many investors see it as a foregone conclusion that margin improvement will likely be much farther out in the future. However, we believe that incremental gross margins could reach +5 to +10% in fiscal 2017 with an incremental $1.6 billion in revenue to roughly $4.1 billion ending fiscal 2017. While this seems like a large improvement, we note that AWS segment operating margins were roughly 14% when it was at $4.6 billion in size, and in Microsoft’s case, it has frontloaded a significant amount of investment (reaching 22 availability zones worldwide in just a few years) and should be able to achieve significant leverage as the service continues to scale off. We estimate that this increase in growth could offset as much as 5% of the transactional decline in fiscal 2017.

The results of Microsoft’s cloud investments are still developing, but this past fiscal year has given investors a reason to be optimistic about the company’s ability to deliver in this area. Top-line growth has been strong and, based on the above commentary, there is reason to believe that this may soon be profitable as well.

Disclosure: IBM, Microsoft and AWS are RedMonk clients.

No Comments