Research and development (R&D) is “essentially an investment in technology and future capabilities,” where companies fund the creation of future products, services, and processes through current expenditures.

R&D may offer a glimpse into a company’s investment strategy, but does the general wisdom of ‘follow the money’ apply to R&D? Does spending money on R&D lead to innovation?

Two schools of thought on R&D spending

It is intuitive that a company cannot create compelling products without allocating money into developing said products. From there it seems straightforward to assume devoting more resources to R&D will improve long-term growth prospects, particularly for organizations competing in a market that evolves as rapidly as technology.

However, there is an opposing viewpoint. On the May 20, 2016 episode of the Critical Path podcast, Horace Dediu spoke about the connection between R&D expenditures and a company’s ability to innovate with the assertion, “there is no relationship whatsoever that has ever been measured between R&D spending and success in the marketplace. None, ever. Ever. It’s on the global level, it’s on the company level, it’s on an industry level. It’s on early, late, middle. Whatever R&D slicing and dicing you want to do, it doesn’t correlate with success.” While Dediu then clarifies that he doesn’t advocate for eliminating R&D spending, he definitively asserts that there is not a direct correlation between higher spending and better results.

Given these seemingly opposing schools of thought, how should we think about R&D spending?

Let’s start by looking at a companies with canonical R&D stories, and then zoom out to the industry at large.

Case Study #1: HP

HP is perhaps the poster child for the camp that believes in the importance of R&D investment. Mark Hurd has been widely criticized for heavy-handed cost cutting measures during his tenure as HP’s CEO, and it is claimed his R&D reductions did long-term harm to the company’s competitive viability.

Observations:

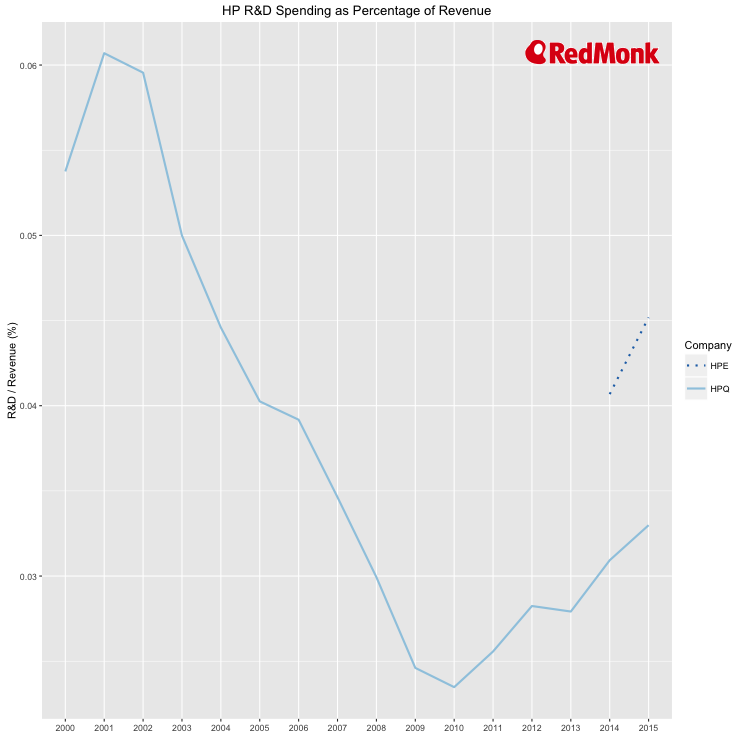

- From this chart it is clear that HP sustained a decade of cuts to R&D spending. To be fair, Hurd was CEO from 2005 – 2010. While R&D spending as a percent of revenue declined precipitously during this time, the trajectory was set well before Hurd took the helm. Hurd definitely bears responsibility for his doubling down on spending reductions, but the responsibility for their acceleration also falls to his predecessor, Carly Fiorina.

- The company’s efforts to right the ship in intervening years required severe actions, including mass layoffs, large write-downs, and – most drastically – splitting the company in two. There is no direct cause and effect between these activities and the R&D levels in the 2000’s, but it does speak to the overall health of the company as it emerged from its period of curtailed investment in its own future.

- In recent years, HP seems to have embraced the concept “HP cannot save its way to prosperity” and has resumed investing in R&D, though still at levels well below industry benchmarks.

What were the results of this tumultuous decade and a half? The company’s overall valuation is almost back to where it was in 2000. HP’s market capitalization (“market cap,” or market value of shares outstanding) was $53.4B at the beginning of 2000; the combined market cap of the component companies HPQ and HPE are now $52.5B. In a time when the market overall grew by over 40%, HP collectively lost 2%.

It’s fair to call the 2000’s a lost decade for HP, and their reduced R&D spending during that time played a role in their direction then and now. With organizations like Wired proclaiming that HP is now among the “walking dead,” it’s easy to make an argument about the importance of investing in R&D and future growth.

Case Study #2: Apple

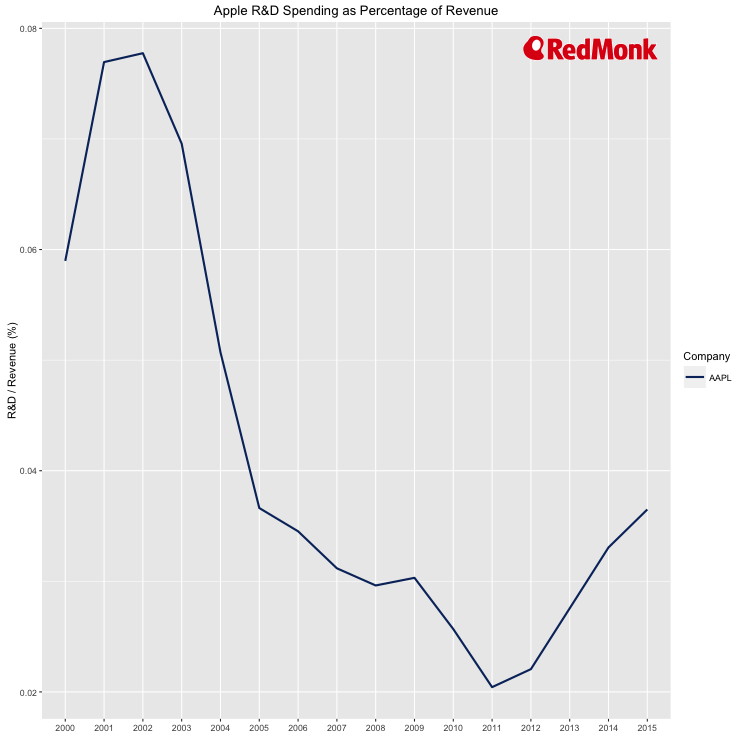

On the other hand, Apple is a prime example of how much can be accomplished with comparatively little R&D. Steve Jobs famously said “innovation has nothing to do with how many R&D dollars you have” and the company has routinely been on the low-end of the industry in terms of the amount of revenue its plowed back into R&D.

For benchmarking purposes, R&D is almost always viewed as a percentage of revenue to try to create an apples-to-apples (pun intended!) comparison across companies of different sizes. Here’s Apple’s R&D as a percent of revenue over the same period, from 2000 to 2015.

Looks familiar, right?

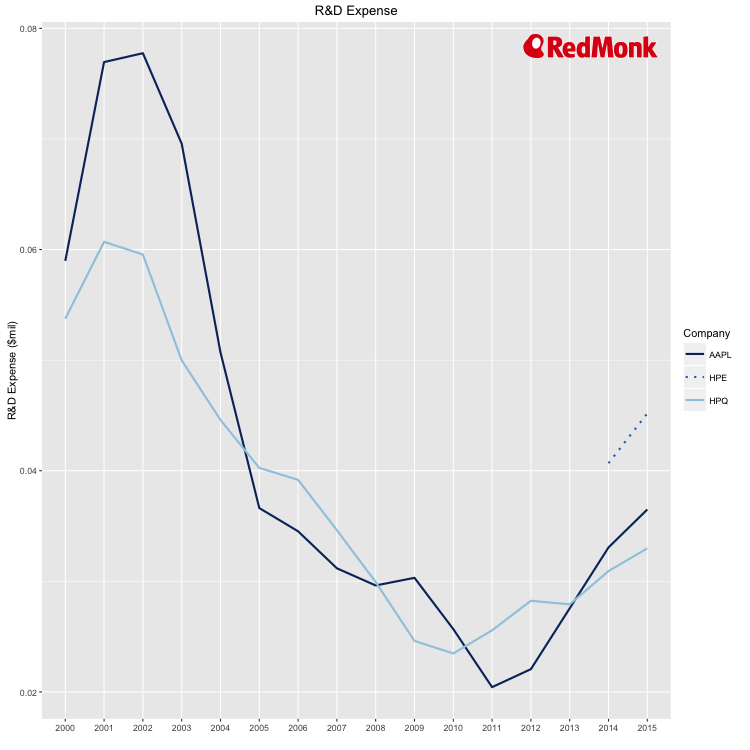

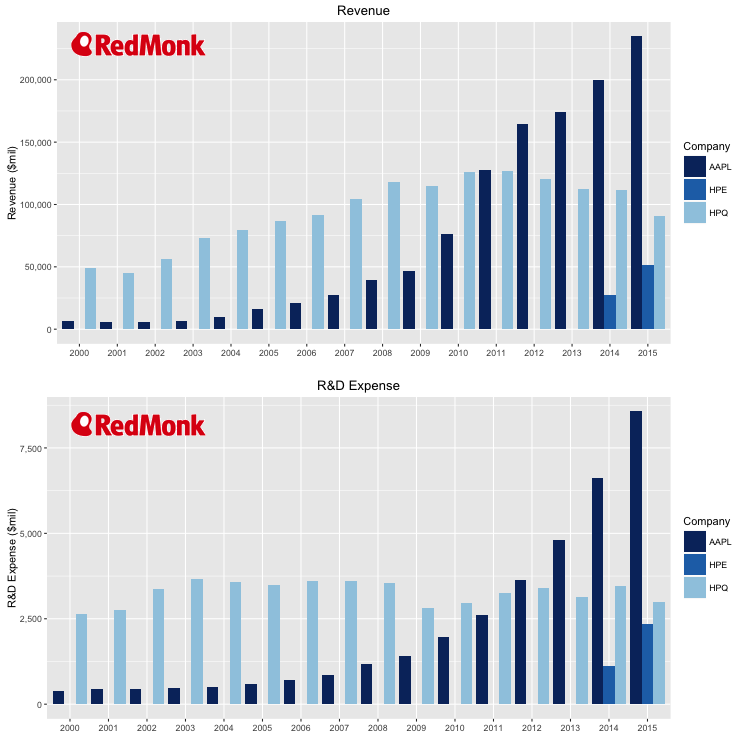

In the past 15 years, Apple has “redefined the computer, music, and consumer electronics industries,” introduced a myriad of successful products, and grown to be the largest publicly traded company by market cap. How was Apple able to achieve such a different outcome than HP when on the face their R&D spending trajectories appear so similar?

The differences between the companies becomes more apparent upon examination of the raw revenue and R&D numbers.

Simply put, Apple did a much better job converting their R&D spending into sales than HP. Apple is incredibly efficient with their R&D investments, even amongst the arguments that their growth in absolute R&D expenditures reveals an impending strategy pivot.

R&D spending across the industry

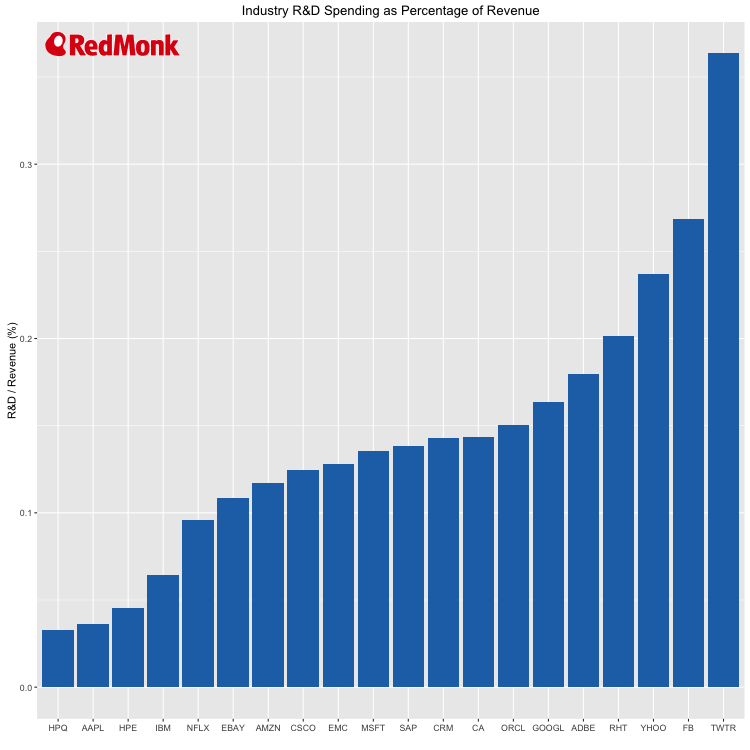

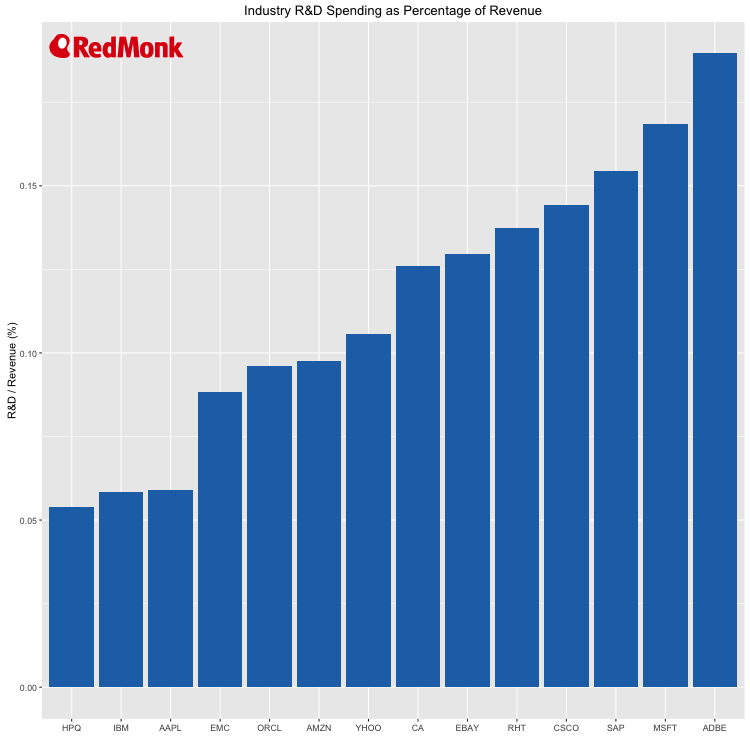

A sampling of public companies from the technology industry shows that in 2015, the median company’s R&D as a percentage of revenue was nearly 14%, compared to a median of almost 12% in 2000.

While typical spending remains concentrated in around 15%, there are now clear outliers spending a great deal more.

- Twitter spent 36% of revenue on R&D, which seems high compared to the group but is down significantly from the 89% ratio they posted in calendar year 2014. Given that Twitter’s 2015 revenue was 1/100th the size of Apple’s, it may be that this metric is primarily a function of their revenue rather than their R&D. Their spending in R&D as a percent of revenue may continue to fall as their revenue increases.

- Yahoo’s R&D spending as a percent of revenue has more than doubled since 2000.

Both company’s recent executive changes and documented struggles adds additional credence to the claim that R&D spending alone cannot buy innovation.

Does R&D spending produce results?

Surviving – and even more, thriving – in the technology industry undoubtedly requires innovation. New product development is a crucial element of success, a company cannot hope to succeed without R&D investment.

However, there mere act of investing in R&D does not guarantee that a company has fostered a culture of innovation that supports that development. Some companies can invest well-below the industry average and thrive while others can invest well above and flounder. It’s not clearly evident that a company’s results are proportional to the amount of R&D money spent.

Disclosure: HPE is a RedMonk client.

No Comments