Significant changes are coming to accounting standards in 2018.

This is admittedly one of the least attention-grabbing openers in RedMonk history; it’s safe to say most of our audience is not concerned about the specifics of implementing new accounting standards. I readily concede that point and promise I am not going to try to convince you otherwise.

However, these changes have impacts well beyond the accounting department. This may not directly impact your role, but these changes are potentially a big deal for your business partners and leadership teams. (And it’s usually good to be at least cognizant of things that are a big deal on your company’s radar.)

This is a quick Q&A session for what’s happening in the accounting world for people who don’t care about accounting.

Q: Alright, what’s going on?

A: The short version is companies around the world, across industries are re-evaluating how they recognize revenue derived from most customer contracts.*

Q: Remind me again – what is revenue recognition?

A: Most businesses recognize revenue when it is ‘earned’ rather than when cash comes in the door (i.e. accrual accounting.) Sometimes this means the company can claim revenue before the payment is received (when the company counts the revenue on their income statement, even if cash hasn’t be received yet.) Other times this means that a company has received the cash before the promised goods/services have been delivered, which means the revenue is deferred (then the early revenue receipts are liabilities on the balance sheet until the company delivers the products and earns the revenue.)

The new standard may impact at what point in time a company can declare that revenue is earned, with the potential for both positive and negative impacts when compared to a company’s current processes and timing.

The main element of the new rules is determining whether revenue has been earned at a single point in time or needs to be recognized ratably over time. All things being equal, a company generally prefers to recognize revenue earlier rather than later. This means that companies will be paying a lot of attention to making sure they’ve met the standards to declare point in time revenue when possible. Alternatively, companies who may have previously had to wait to record revenue related to professional services or solution sales may see revenue recognized earlier than in the past.

Q: This seems like an issue of semantics. Is it really a big deal to change when revenue is recognized if the total dollars remain the same?

A: Timing of revenue drives timing of expenses, both of which drive profit in a given period. There will also be balance sheet impacts; changing revenue recognition affects deferred revenue/accounts receivable, and additional rules mean some long-term customer acquisition costs will now be capitalized.

The total value of a contract may not change, but it’s worth noting that changes to when/how the contract is accounted for impacts some key financial metrics.

Q: What’s driving the change?

A: In 2014, two bodies that govern U.S. and European accounting standards (FASB and IASB) each agreed to replace their existing revenue rules with new, converged guidelines. After years of transition, it’s go time.

The primary goal of the change is to improve comparability across industries and markets. The old system had industry-specific rules about how and when companies could recognize revenue, and the U.S. and international rules were not always in sync. These changes address those disparities.

New disclosure policies will also provide more transparency and insight into a company’s revenue recognition process.

Q: What’s changing?

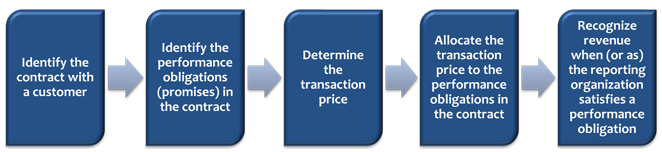

A: For U.S. companies following U.S. GAAP (Generally Accepted Accounting Principles), we say goodbye to over 20 years of prescriptive industry specific guidance and say hello to a single principle-based standard. As you can imagine with accounting standards, even moving to ‘principles’ rather than ‘rules’ still requires an excruciating amount of detail. At a high level, the high level five-step approach to recognizing revenue is:

Image source: FASB

Q: I have a feeling I don’t care about most of those excruciating details. What should I know about?

A: Here are a few things to keep in mind, especially if your company is a technology vendor.

My company sells licensed software:

– Licensed software is considered “functional IP”. Most of the time functional IP will be recognized as point in time revenue. However, there is an exception if ongoing software updates are a crucial element of your software’s functionality. (The commonly used example here is anti-virus software; without ongoing updates the software is for all intents and purposes useless. Compare this to an older version of an operating system where core functionality remains intact even as new updates are added.) In those instances where updates impact usability, your company has an ongoing performance obligation to update the software to maintain functionality, which means you can’t claim revenue for the software sale upfront and instead have to recognize it over time.

– Does your company sell customized software rather than off-the-shelf licenses? If so, it may be deemed that the value of customizing and integrating the software is inextricable from the base software. If so, you may likely recognize revenue related to the license and services on a combined basis over the time period the services are performed.

My company sells support and maintenance or professional services in addition to software:

– Maintenance or professional services revenue will be recognized over time as the services are provided. Where this gets tricky is when you sell software in conjunction with professional services. While license revenue can likely be recognized now (see above), unless the contract makes the obligation to deliver software distinct from the ongoing support all of the revenue will need to be recognized over time. (For example, a contract that indicates you will be paid $5,000 for a software license with 10 hours of professional services is not sufficiently distinct. Instead your contract needs to place a dollar amount on both the license and the maintenance and call out the value of providing professional services at $x/hour for y hours.)

My company is a SaaS company:

– Given that people were already paying you over time, the accounting for your core offering is unlikely to shift substantially. However, bundled services (implementation/setup, support/maintenance, hosting fees, etc) would need to follow the same steps of being distinct in the contract as discussed above if you want to recognize their revenue timing differently from the the revenue generated by the software.

Q: Does this impact my company?

A: Probably. Zuora CEO Tien Tzuo calls the changes “the most profound new compliance changes to come to corporate finance since Sarbanes-Oxley” while Hortonworks CFO Scott Davidson says “it impacts every aspect of how you go to market and run the business, requiring changes in systems, processes and reporting both internally and externally to investors both public and private.” (both sourced from Forbes – beware: autoplaying video)

If you work for a public company, this impacts your business. Non-public companies are not required to comply with GAAP rules, but many do anyway, so it’s also likely to be on your company’s radar.

The degree to which the company is impacted depends on what kind of contracts they have in place. Companies with single lines of business are less likely to be impacted than companies with multiple business lines. Companies that have standardized contract processes in place will probably adapt more easily than companies that have highly variable negotiated deals. Companies with shorter contract horizons may have an easier time than companies with longer-term deals.

Q: Who in my company is dealing with this?

A: This has the potential to impact a lot of groups.

– Your accounting and finance teams are doing a bulk of the lifting in terms of updating accounting processes, updating internal and external reporting processing, and recasting numbers.

(Quick note on recasting: To give comparability over time, companies can’t just change how they report their numbers going forward. Instead they will either perform a ‘full’ or ‘modified’ retrospective. In the former, the will recast the results of the prior years on their financial statements as though the new standard had been in place the whole time. For the latter approach, the company will determine the cumulative affect of the changes and enter it as an adjustment to their retained earnings.)

– The legal department will need to review and potentially change how contracts are drafted to ensure that contracts reflect distinct obligations.

– A deal’s transaction price is impacted by things like rebates and commissions, and deal sweeteners like extended warranties and or free support may change how the company can recognize revenue on the whole deal. As such, your sales team may have new drivers for their quotas/commissions and may need to adjust their go-to-market approaches for their sales.

Q: What’s the timeline?

Some companies have already been early adopting. For those that haven’t, if you’re at a U.S. based public company, these rules go into effect for fiscal years beginning after December 15, 2017. International public companies apply the standard beginning January 1, 2018.

If your company is not public but follows GAAP reporting, you have until December 15, 2018.

Q: Anything else I should be aware of?

A: A couple of parting thoughts:

- Note that any work done without a valid contract cannot be recognized as revenue, so be careful about engaging in spec work.

- Be wary of graphs you come across on Twitter, etc that show long-term financial trends for companies. How and when companies adopt the standard (i.e. full or modified retrospective, and early adoption vs. adopting in 2018) may make apples-to-apples comparisons difficult across companies, and the change in the standard may impact the metrics within the company over time.

Disclaimer: Please remember I am not an accountant (let alone a CPA) and as such this should neither be viewed as comprehensive nor as professional advice.

* There are a few exceptions for certain types of contracts like leases, insurance, financial instruments, and warranties.

No Comments