Rackspace announced that it is being acquired in an all-cash deal valued at $4.3B. Pending regulatory anti-trust approval, the firm will be taken private by a group of investors led by Apollo Global Management in Q4 of 2016.

This valuation equates to a price of $32/share. The 38% premium cited in the announcement is calculated against a base share price from August 3, as the news about the pending acquisition began increasing the company stock price as early as August 4.

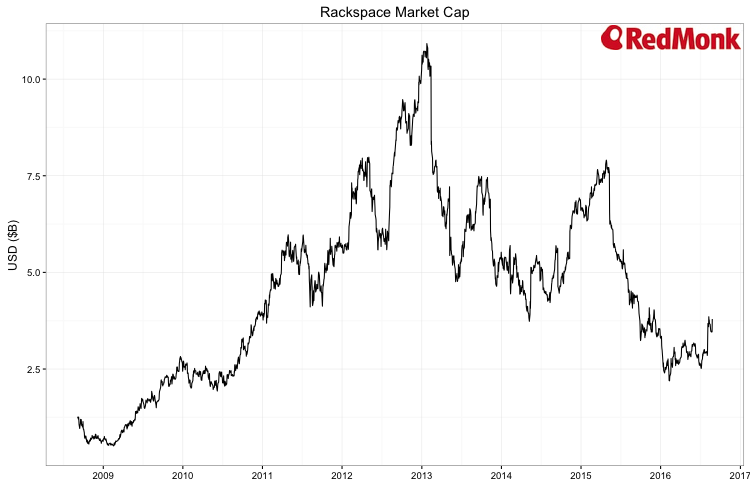

For historical context, this valuation falls considerably below the company’s peak market capitalization in January 2013 when Rackspace was worth $10.9B. This means that the company’s current valuation – including the premium – is less than 40% of what it was at its highest point.

Data source: Y charts

At one time, Rackspace was one of the largest suppliers of hosted and managed infrastructure. Though they were once one of the early arrivers and main competitors in the space, Rackspace now partners with major players like Amazon and Microsoft rather than competing against them directly. Rackspace has been transparent about its pivot from supplying cloud infrastructure to supporting it. While the company still offers their own hosting services, their current investments in cloud infrastructure are dwarfed by larger competitors.

As a managed cloud provider, Rackspace has focused on “helping companies shift their IT operations to its larger competitors’ servers.” AWS’ managed service provider directory provides a fairly concise description of Rackspace’s positioning:

“Rackspace helps businesses realize the power of the Amazon Web Services cloud from a trusted partner with a track record of managing business-critical applications. Rackspace engineers deliver operational tooling, best practices, and specialized expertise on top of Amazon Web Services.”

In his blog post discussing the logic of the acquisition, Rackspace CEO Taylor Rhodes cites the company’s need for more strategic flexibility and lauds Apollo’s “patient, value-oriented approach.” Going private will ideally provide the Rackspace leadership team with the opportunity to complete their pivot with a longer horizon than is typically granted by public markets. Hopefully moving out of the public gaze will allow Rackspace to innovate and transition their business without the pressure of the “90 day shot clock” that comes with public earnings releases.

Disclosure: Amazon and Microsoft are current RedMonk clients.

Links 26/8/2016: Maru OS Resurfaces, Android More Reliable Than ‘i’ Things, PC-BSD Becomes TrueOS | Techrights says:

August 26, 2016 at 6:38 pm

[…] Rackspace to be Acquired for $4.3B […]