About vFunction

vFunction was founded in 2017 by Moti Rafalin, Amir Rapson, and Ori Saporta. The trio most recently worked together at WatchDox, a data security company that was acquired by Blackberry in 2015. vFunction emerged from stealth earlier this year with an assertive platform play for modernizing monolithic Java applications.

With headquarters in Palo Alto, CA and offices in Israel, the team is currently led by Rafalin (CEO), Rapson (CTO), Saporta (Systems Architect), and Bob Quillin (Chief Ecosystem Officer).

The vFunction elevator pitch (per vFunction):

vFunction is the first and only platform for developers and architects that intelligently and automatically transforms complex monolithic Java applications into microservices, restoring engineering velocity and optimizing the benefits of the cloud. Designed to eliminate the time, risk and cost constraints of manually modernizing business applications, vFunction delivers a scalable, repeatable factory model purpose-built for cloud native modernization.

App modernization is a massive business opportunity; pretty much every enterprise company has a substantial legacy Java estate that they are trying to modernize, often with a view to cloud deployment. These legacy apps are often poorly documented, generally monoliths, without a good service view. IT organizations have been tasked with decomposing these apps into microservices. That’s the problem vFunction is looking to help with.

Size

- 15 employees

- $12.2m seed round led by Shasta Ventures and Zeev Ventures announced February 2021

- Sales worldwide, primarily in the U.S., EMEA, and Asia

Product

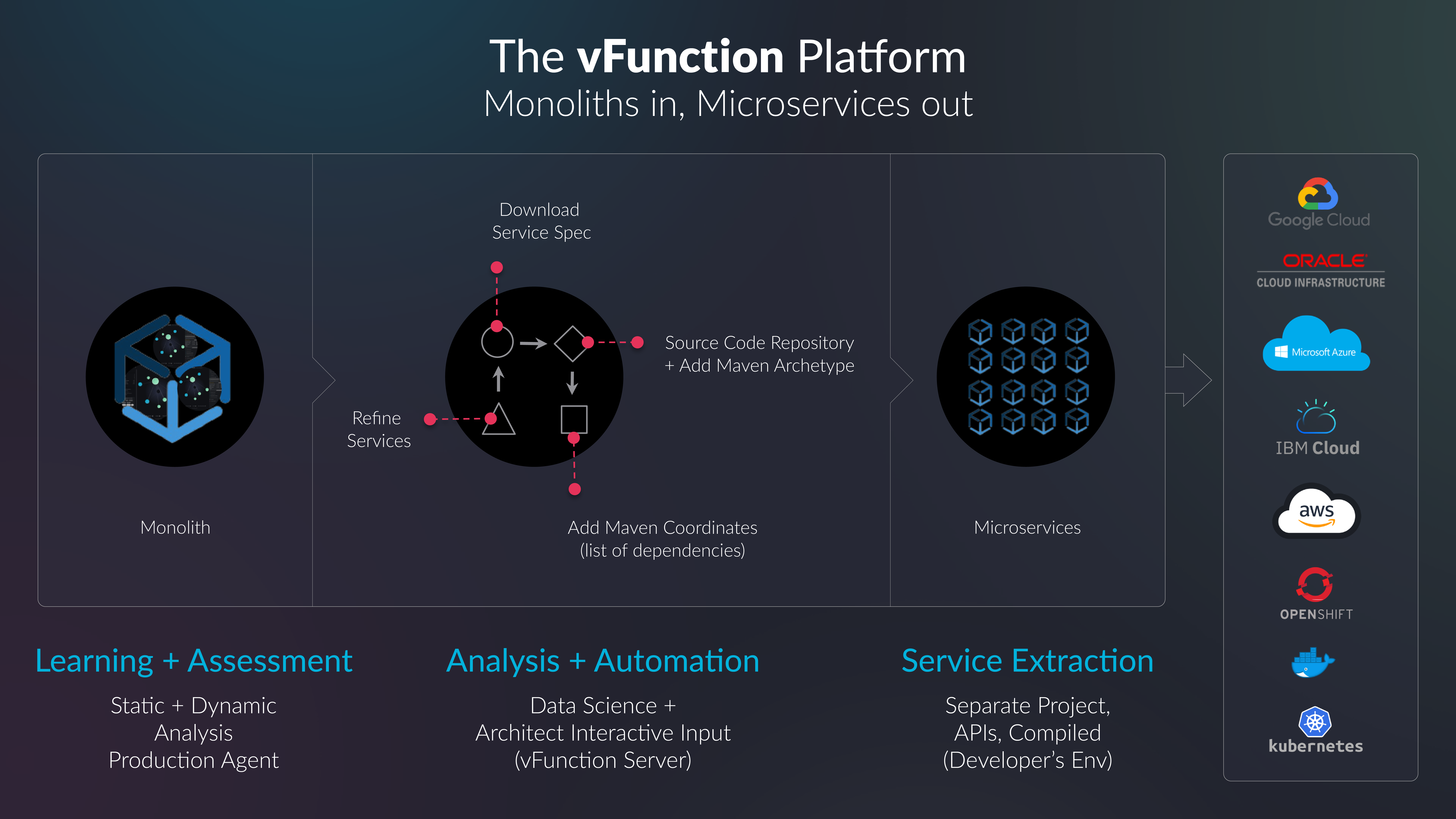

The vFunction Platform promises “modern modernization” of monolithic Java applications by systematically breaking them down into microservices suitable for cloud-based deployments. vFunction employs locally installed agents (similar to those used by application performance management tools) that collect information about an existing application. In order to collect as much information as possible (and invoke all pertinent code), the agents would ideally be installed in production, although analysis of test environments that mimic production conditions (e.g., via integration tests) can suffice. The platform analyzes the information gathered and then decomposes the application into microservices/projects and APIs. It also offers dead-code detection functionality based on what is invoked while the agents are collecting data.

While the tech behind the platform is proprietary, vFunction describes the modernization process as based on a combination of “dynamic analysis, static analysis, data science and automation.”.

Diagram of high-level transformation steps involved in the vFunction Platform:

Even with an automated and repeatable process, it is worth emphasizing that the platform is designed to manage multiple application modernization projects, using dashboards and interfaces to provide visibility across all stages of the decomposition and modernization processes. At present the platform is licensed on a per-application basis.

GTM and Competitive Landscape

vFunction’s go-to-market is based on direct sales with support from SI partners. Ecosystem partnerships with the likes of IBM, Red Hat, and Oracle are in the early stages, with some integrations (such as an OpenShift Operator) already available. While the proposition of accelerating application refactoring for the purpose of Kubernetes-based deployments opens up potential partnership pathways (and gives vFunction customers a wide range of potential deployment targets), as more integrations and pathways emerge to help streamline the deployment of vFunction-refactored applications to specific platforms (OpenShift, VMware Tanzu) and public clouds, a partnership with vFunction will become all the more appealing for vendors looking to accelerate the migration of Java-based workloads to their own offerings.

As noted above, app modernization and digital transformation initiatives are big business at present, with organizations weighing a number of rehosting, replatforming, and refactoring options. Some companies ultimately choose to continue to maintain legacy monoliths as they are due to the substantial time, monetary, and personnel investments often involved with modernization.

vFunction is to some extent competing with consulting and outsourcing firms and vendor-specific consulting teams that specialize in refactoring (such as Tanzu Labs–VMware’s recent rebrand of Pivotal Labs). It is also up against lift-and-shift and replatforming options that are often pitched as a middle ground between legacy app maintenance and a more resource-intensive re-architecting. Organizations with sufficient skill sets and hiring power also have the option of in-house DIY transformation initiatives. However all of these plays can be seen as channel opportunities for vFunction; companies in the Indian outsourcing industry for example are likely to be major customers.

There are, of course, a number of profiling and modernization tools out there, with new initiatives emerging with increasing frequency. Earlier this year, for instance, VMware announced Project Iris, which is designed to accelerate digital transformation by first assessing applications within a portfolio and then making rehost, replatform, or refactor recommendations; it also includes functionality for streamlining the replatforming of Java applications for a Kubernetes environment.

Another RedMonk client, Diffblue, provides automated tooling to improve unit test coverage for Java apps, which could be complementary to vFunction.

If vFunction works effectively, with sufficient levels of automation for refactoring monolithic Java applications at scale, it’s going to see plenty of growth. vFunction should be seen as a tool to accelerate refactoring work, reducing some project times from weeks to days. Some manual effort will still be needed, but it’s about reducing that overall effort. Migration factories are nothing new in IT; we’ve seen them notably in the mainframe/COBOL market. It makes sense to industrialize skills, processes, and tools to facilitate rehosting and refactoring.

Java may not be the hot new programming language on the block, but it’s where a lot of the money still is. AWS, Microsoft Azure, and Google Cloud are all investing heavily in Java in order to be seen as attractive deployment targets for migration efforts and new workloads. vFunction is therefore likely to be pushing an open door with SIs and cloud hyperscalers alike. As such it is likely to be an attractive acquisition opportunity.

Disclosure: vFunction is a RedMonk client, but this is an independent piece of research that has not been commissioned by the client. AWS, Diffblue, Google Cloud, IBM, Microsoft, Oracle, Red Hat, and VMware are also RedMonk clients.

No Comments