Much ink has been spilled in the wake of Silicon Valley Bank entering FDIC receivership on Friday, March 10, 2023. If you’re looking for coverage behind the events of the bank run, I recommend Ben Thompson and Matt Levine’s analyses (1,2, 3).

There was very disappointing behavior on display from the community following the bank’s collapse. As Thompson put it:

A similar critique could be applied to the behavior of some subset of VCs on Twitter over the weekend, which at times seemed directed towards sparking bank runs in other regional banks, with the goal of forcing the FDIC to step in and make depositors whole, whether or not their funds were insured or not. It was pretty ugly to observe, but ultimately, it was successful: the FDIC, Treasury Department, and Federal Reserve stepped in.

– Ben Thompson

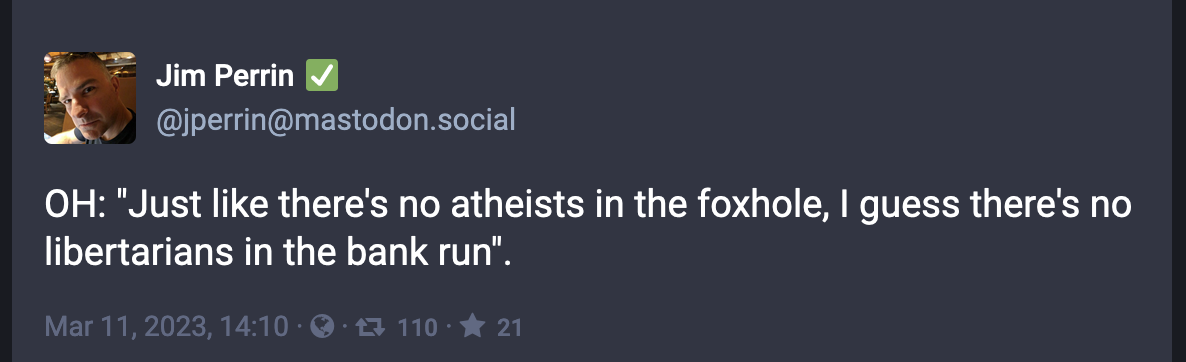

An even more succinct call out of the hypocrisy on display is summed up with this:

But just as members of the tech ecosystem were actively spreading FUD that created and amplified the crisis, there was also a broad community that emerged to support one another through it.

Rather than dwell on the failures of SVB bank executives, of VCs, of systems and regulators, of politicians, and of armchair quarterbacks fanning the flames on all of the above, instead I choose to spend my energy looking for the people who sought to build while the institutions around them fell.

Here are a few examples that I came across:

- Payroll processing company Rippling banked with SVB, which meant that there was a potential ripple effect (sorry, terrible pun) for the employees of Rippling’s customers not being able to be paid on time if the Rippling’s cash was not accessible. Rippling took this risk seriously and fronted their own capital to cover immediate paycheck runs for their customers.

- The company Remote helps companies hire globally, including through being the Employer of Record for companies to contract through. Remote did not have SVB exposure, but knew their client base did. Rather than impacting payment to contractors, Remote is covering March payroll for any client unable to access funds due to SVB.

- A variety of companies stepped up to help offer bridge loans and emergency lines of credit for companies concerned about making payroll, including Arc, Brex, Capchase, Founderpath, Kriya, Nitra, Tapline,Wayflyer and others (including individuals, not just companies)

- Numerous people offered to do pro bono crisis comms and PR work for impacted companies.

- People aggregated resources for one another, like this doc.

There are plenty of people in the sidelines who are critical of these efforts (“it’s self-serving” and “it’s tasteless to use this event for marketing”) Maybe that’s fair, especially given the fact that many of these offers were unnecessary on Monday when SVB funds were accessible from the FDIC.

That said, I appreciate the spirit of these offers. I appreciate the fact that the teams at these companies undoubtedly poured a full weekend of work into crafting potential solutions while the FDIC details were still in flux. I appreciate people who try to help.

No Comments