Another day, another rug pull. At least that’s what the cynical might say, as we as an industry once again are discussing the fallout of another company changing their software from what was previously open source to a proprietary license.

There are once again renewed conversations around license changes, and with that comes the question: have the companies that have changed from open source licenses to proprietary licenses experienced material improvement in their financial positions following the license change?

It’s a good question, and unfortunately one that is difficult to answer from the perspective of an outside observer. The set of companies pursuing this strategy that also have publicly available financial information is small.

That said, it’s worth exploring whether there are notable trends even within the small sample size.

Goal: Examine if changing an underlying open source project’s license from an OSI-approved license to a proprietary license has a measurable impact on financial outcomes for the commercial entity backing the project.

Why: There has been a growing trend of entities relicensing their projects to proprietary licenses after initially gaining traction as open source projects, especially in the database space. This is largely attributable to pressure from investors. Given that companies are pursuing this strategy with the deliberate intention of stifling competition to bolster their financial results, have we seen evidence that the act of changing a license has a meaningful impact on financial outcomes?

How: There are two primary constraints in trying to look at these changes. We are confined to 1) public companies that have 2) changed their underlying software license, as that is the only way to have visibility into financial metrics. The sample size is accordingly small.

Who and when: Based on the above criteria, these are the companies we’re looking at:

- MongoDB: MongoDB IPO’d as a company in October 2017. They changed the license of the underlying database from the AGPL to the Server Side Public License in October 2018.

- Elastic: Elastic IPO’d as a company in October 2018. They changed the license of the underlying Elasticsearch source code from Apache 2.0 to a dual SSPL/Elastic License in January 2021.

- HashiCorp: HashiCorp IPO’d December 2021. They changed their software license from the Mozilla Public License v2.0 to the Business Source License in August 2023.

- Confluent: Confluent changed components of their platform from an Apache 2.0 license to the Confluent Community License in December 2018 while they were still a private company. They then IPO’d in June 2021. (Please note this pattern is backwards from the others. We do not have financial information about how the company was faring prior to the license change. That said, we’re including it here to examine how the company has managed in the time period for which we do have available data.)

Limitations: Even within these already narrow confines, there are still substantial limitations to this data set.

- Are there confounding variables? Definitely. The companies’ financial results are impacted by more than just the license change, and as such the results will include additional noise beyond the scope of our problem space. These results capture the totality of a company’s decisions, only one of which is licensing.

- Company valuations change not only because of their own underlying fundamentals but because of the condition of the market at large. There is noise created by the macroeconomic environment overall. Also, because the time windows we are examining are not consistent, there are going to be variable underlying factors in the financial data.

- There’s no time machine. We can look at what happened, but we don’t have data revealing what might have happened if the companies hadn’t made the change.

What: We want to use publicly facing financial data to examine:

- Changes in company revenue over time

- Changes in company market cap over time

- Changes in company net income over time

Results:

Revenue

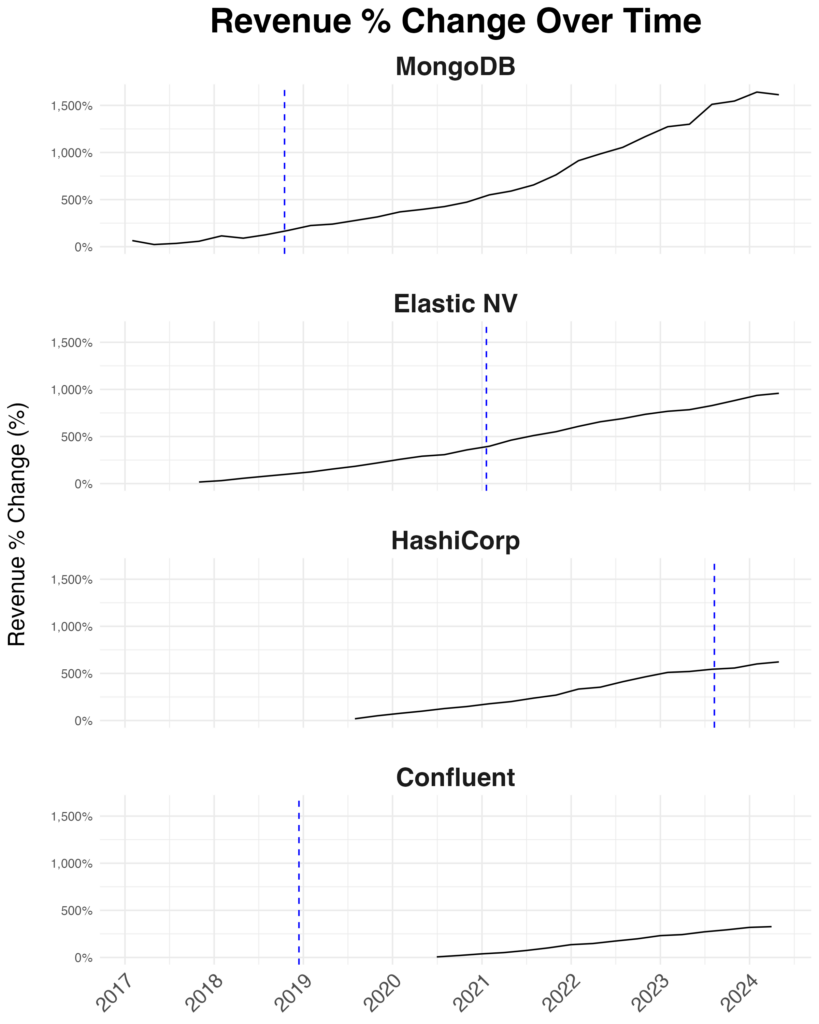

Okay, so the first question is: in our sample, do the companies that change their license see an increase in revenue?

The below chart shows change in revenue over time for each company, with the blue vertical line denoting when they changed their license. X- and Y-axes are held constant for ease of comparison, which means there is more data available for companies that IPO’d earlier.

From this data set, we see that revenue increases after the license change, but the rate of increase is not materially different than the rate of increase prior to the license change.

Market Cap

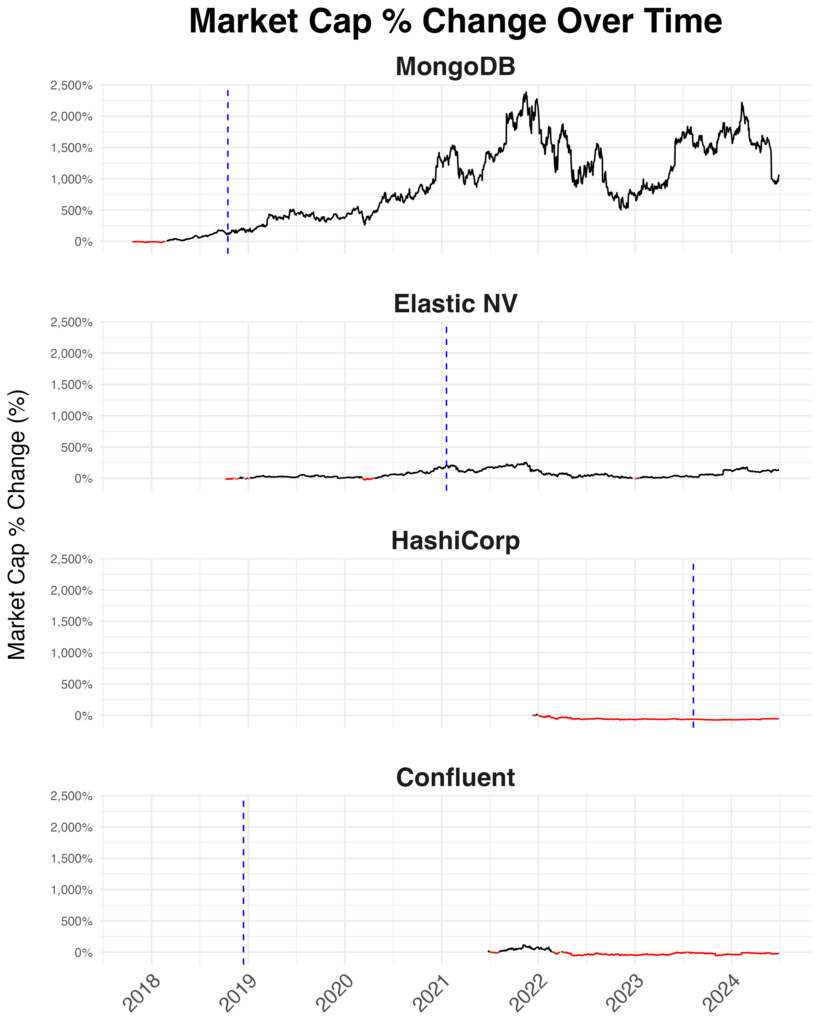

Market Capitalization is a measure of a company’s value. (Market cap is more useful than comparing just stock price because it also takes the number of shares available into account; it gives a more complete picture than stock price if you’re trying to do cross-company comparison.)

How do companies that changed their license fair in valuation? That’s more of a mixed bag.

These charts show change in company value over time; the lines are black when the company’s value is higher than its IPO valuation and red when they are below. Again, the blue vertical lines denote when they changed their license and X- and Y-axes are held constant.

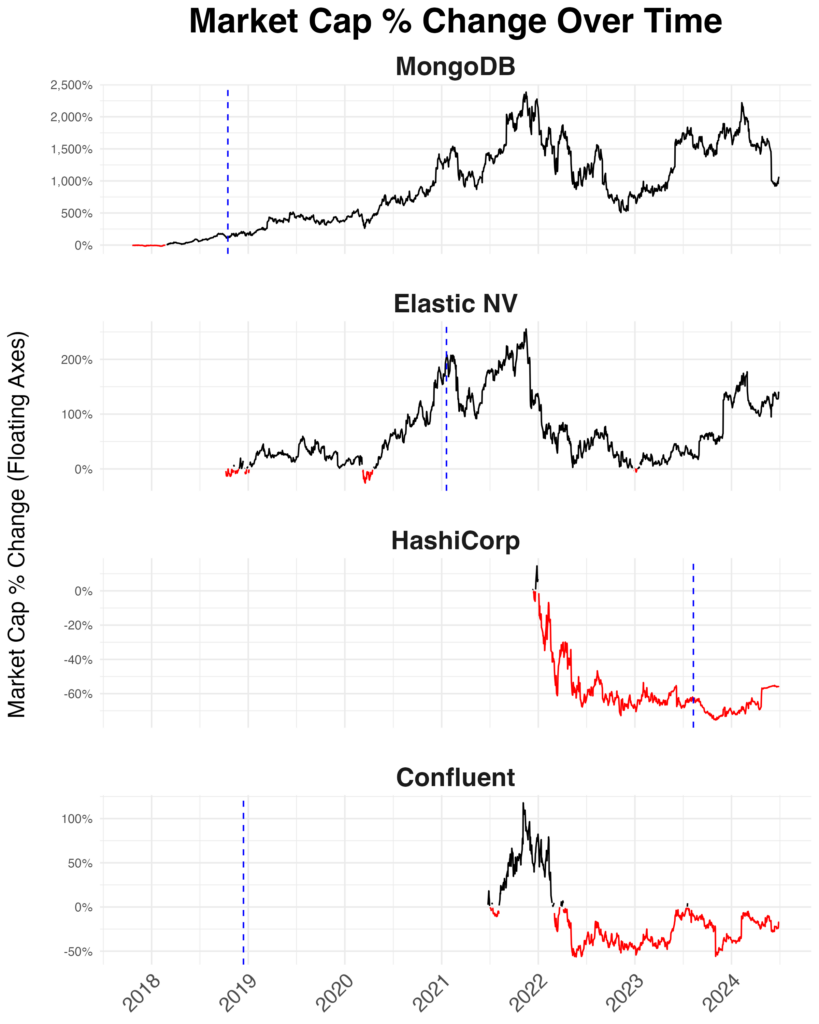

Since Mongo’s growth numbers skew the charts so much, here’s a version with free-floating y-axes for each company.

MongoDB experienced tremendous growth in company value post-license change. Elastic grew, but at a much more moderate rate. HashiCorp has struggled and seen their valuations drop post-licence change.

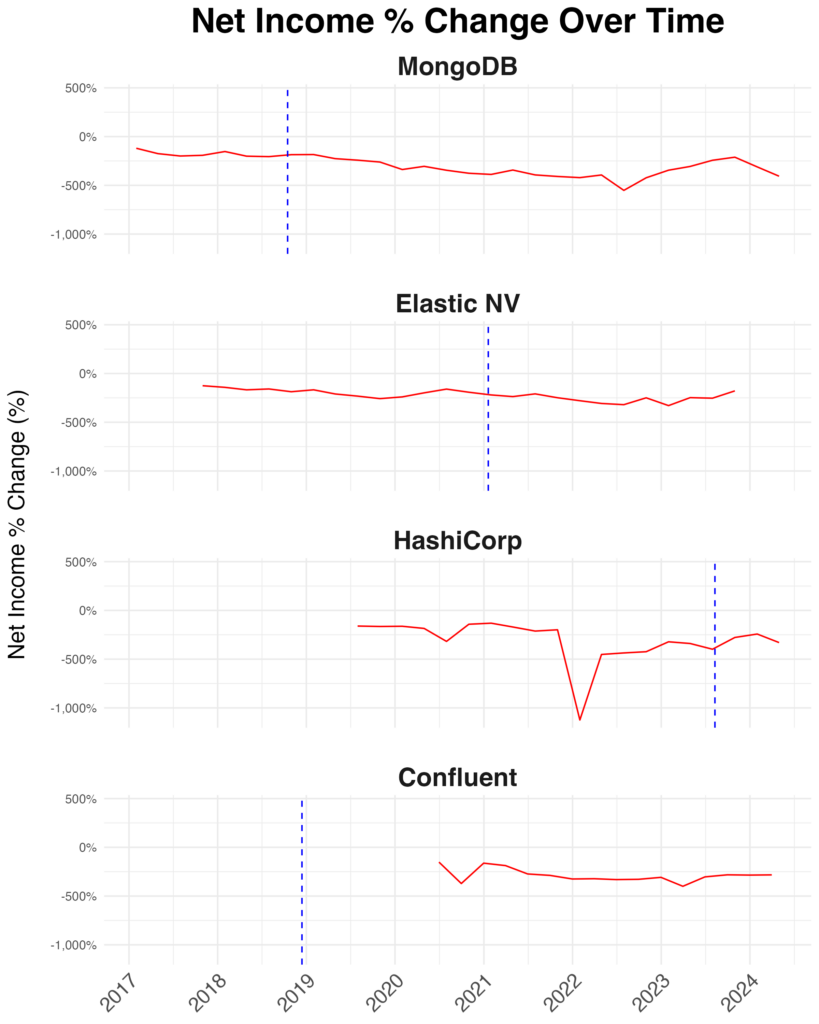

Net Income

Finally, it’s worth noting that none of these companies are profitable yet. This means that valuation is primarily driven by expected growth in future cash flow.

Conclusion

While in our sample we see revenue grow post-license change, we don’t see a notable change in the rate of growth. We also see very mixed results in company valuation, and there does not seem to be a clear link between moving from an open source to proprietary license and increasing the company’s value.

Related links:

- An analysis of license changes and project forks: The Post-Valkey World

- Why is the database market in particular pursuing a license change strategy? Cockroach and the Source Available Future

Disclosure: Elastic, HashiCorp, and MongoDB are currently RedMonk clients. Cockroach Labs and Confluent are not.

No Comments