Commentary on some of the interesting numbers in the news

(Photo credit: Flickr/morebyless under CC-BY 2.0)

Last week we saw a slew of SaaS-based companies file prospectuses for their upcoming public offerings.

- Snowflake: a cloud-based data warehouse for structured and semi-structured data (IPO)

- Asana: a team collaboration and project management tool (direct listing)

- Sumo Logic: a data analytics and monitoring platform (IPO)

- JFrog: an artifact and binary management platform that powers software releases (IPO)

(Unity and Palantir also filed but will not be covered here.)

While S-1’s are definitionally filled with numbers for us to choose from, I in particular wanted to focus on how these various companies talk about their use of cloud infrastructure.

Cloud Spend

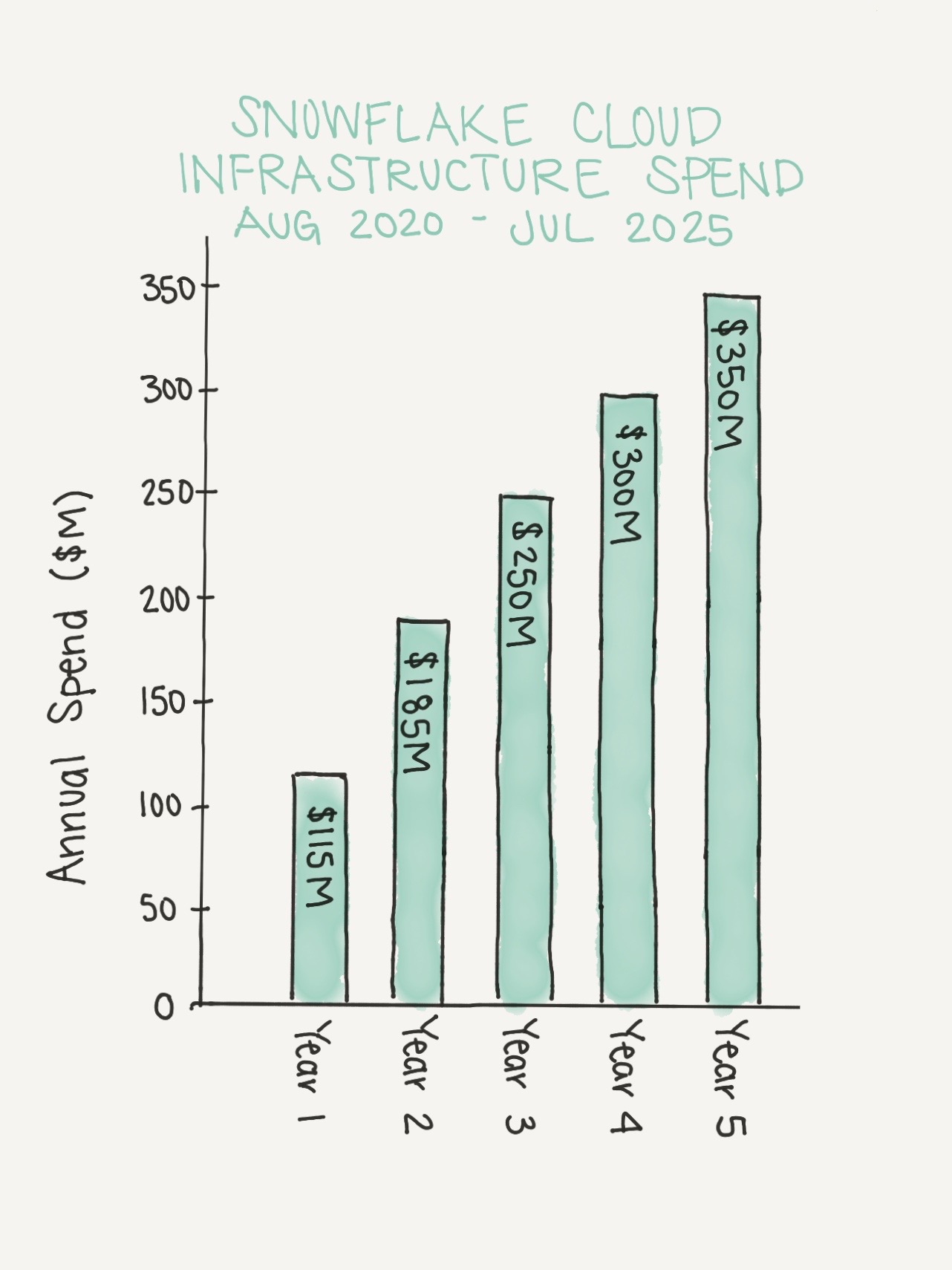

All of these services operate on public cloud infrastructure, but of the companies listed above, Snowflake has the deepest financial commitments to cloud. According to their S-1, “the Company has committed to spend $1.2 billion between August 2020 and July 2025 on cloud infrastructure services” starting with a $115M commitment the first year and ramping to a $350M annual commitment in year 5.

While the company does not disclose specifically which provider this contract is with (Snowflake lists all three major hyperscalers as providers of infrastructure), they do note that “a substantial majority of our business is run on the AWS public cloud.” Third-party cloud infrastructure expenses drive the majority of Snowflake’s COGS.

Given the data-centric nature of their workloads, it’s no surprise that Snowflake’s infrastructure spend far outpaces the spend of the other filing companies.

- Sumo Logic uses AWS. While we don’t have contract details, the company lists $63.2M in total hosting commitments, split to show $37M due within a year and another $26.3M due within the next 3 years.

- Asana also uses AWS for infrastructure and is committed to spending $20M over the next two years.

- JFrog offered no commentary on their cloud contracts and didn’t break out specific details on what they are spending on hosting. However, their non-cancelable purchase obligations are valued at $18.9M over the next three years. They specify the commitment is “mainly for hosting,” but that number is co-mingled with other expenses and should be treated as an imprecise directional estimate.

These represent pre-committed spend numbers, and do not account for extended contracts or additional capacity purchases along the way.

Cloud Co-opetition

These numbers represent substantial spend commitments, especially for companies that are not yet turning an annual profit. Most of the companies explicitly noted cloud expenses as a risk factor, in addition to the risk of outages or security breaches outside of their control. These are potential operating risks of using cloud.

The inherent tension of cloud platforms, however, is that cloud providers are also a potential revenue risk.

The reality is that any of these companies’ business models could in theory be rendered obsolete by the platforms they rely on.

- Snowflake directly competes with the database products provided by cloud vendors.

- Improved monitoring and analytics functionality within the platforms could undermine Sumo Logic’s value proposition.

- Microsoft is working in the same space as JFrog with their Azure DevOps and GitHub products.

- Asana is probably most sheltered from direct competition with cloud providers, though both Microsoft and Google have office productivity product offerings in other areas of their respective companies.

Every one of these SaaS providers relies on cloud vendors as their infrastructure provider with the awareness that cloud is also a competitive threat. On the flip side, the cloud providers rely on their customers for revenue while also constantly looking to improve their platforms, potentially by directly implementing some of the features popular in third-party tools.

This is not a new phenomenon, but reading through the explicit language in the S-1’s serves of a reminder of that co-opetition dynamic. Here’s how Snowflake describes cloud competition in their risk factors.

There is risk that one or more of these public cloud providers could use their respective control of their public clouds to embed innovations or privileged interoperating capabilities in competing products, bundle competing products, provide us unfavorable pricing, leverage its public cloud customer relationships to exclude us from opportunities, and treat us and our customers differently with respect to terms and conditions or regulatory requirements than it would treat its similarly situated customers. Further, they have the resources to acquire or partner with existing and emerging providers of competing technology and thereby accelerate adoption of those competing technologies. All of the foregoing could make it difficult or impossible for us to provide products and services that compete favorably with those of the public cloud providers.

In other words, when Snowflake opens the dictionary and looks up the phrase “necessary evil,” they’re less likely to find text than logos – three in particular.

Disclosure: Asana, JFrog, and Snowflake are not currently RedMonk clients. AWS, GitHub, Google, Microsoft, and Sumo Logic are current RedMonk clients.

By The Numbers #19 | Chris Short says:

September 21, 2020 at 11:38 am

[…] By The Numbers #19: […]