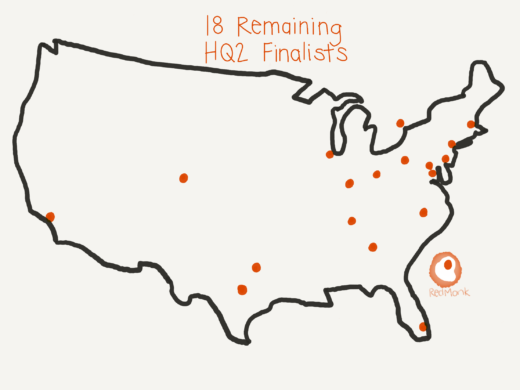

Amazon just announced the locations for its new headquarters outside of Seattle, committing to bringing 25,000 jobs each to New York City and Northern Virginia. The process took over a year, beginning with soliciting bids from 238 metro areas, narrowing the list down to 20 finalists, and then ultimately splitting the “HQ2” between two east coast hubs.

What does this mean for the 18 other finalist cities now that Amazon’s dance card is full?

For Cities That Were Passed Over

Even though you weren’t Amazon’s ultimate choice, all is not lost. Over the past year, you experienced a fair amount of national earned press focused on how you’re a top city in which to do business.

Over the long-term you can double down on that reputation by: 1) continuing to invest in your K-12 and university education systems to build up your available educated workforce and 2) start making those infrastructure investments you promised to Amazon.

In the shorter term, you have a couple of paths towards building your economic tech base. The first is to seek external growth from new companies, but second is to re-examine your own backyard. Remember that “tech” jobs are not the exclusive purview of tech companies. You probably have companies currently in your city that are in the middle of the ‘business transformation’ process. Often a significant part of building a tech-forward, agile business strategy is a re-shoring of development jobs.

Your city doesn’t need Amazon to be a technology center of gravity; you can also use the tech talent of your local industries as a wellspring to help attract traditional technology companies. Enabling your local tech talent pool will not only have immediate economic results, but will also make it easier to attract more companies in the future.

Tax incentives are one tool you have at your disposal, yes, but there are other paths that can help. Off the top of my head:

- do you run tech-focused job fairs?

- do you participate in community events like startup weeks?

- are your local libraries running technology classes? does your library membership offer access to online courses like lynda.com?

- courting higher-ed is standard path towards economic partnerships, but have you expanded that view to include boot camps and code schools?

- do you have public-private hackathons and prizes that encourage community use of public data?

- are there underutilized physical city spaces (building lobbies, conference rooms, etc) that you could offer to freelancers and startups?

- have you looked at economic development job creation grants on an individual level, not just a corporate level?

For Vendors

By publicizing their search process, Amazon has shared some significant due diligence with you. You now have a list of 18 qualified communities that Amazon has determined have a reasonably deep talent pool, solid infrastructure, and a hunger to bring in technical jobs to their local economy. You may not have exactly the same selection criteria as Amazon, but you should consider this shortlist of cities as useful and actionable information in your strategic planning.

Cities around the country are excited to be viewed as tech hubs, and losing out on HQ2 doesn’t change these cities’ interest in pursuing technical job creation.

Expanding Your Own Operations

If you’re interested in serious geographic expansion, this may mean your company will find motivated policy makers and economic development councils that have already begun internal discussions about how to spur economic development in their region. As a tax payer I’m not sure I can morally advocate for the ‘pit states against against each other for tax incentives’ strategy, but given the eye-popping numbers on the table, I’m also not sure it would be fiscally responsible of you not to. It’s an extremely flawed system, but some data points to at least consider:

- The total incentives offered by the winning cities comes to $2.8B. This includes a $22K cash grant per job created in Virginia, and a $48K tax-credit per job from New York.

- Even the failed bids were eye-popping. For example, Maryland pledged $8.5B and Newark pledged $7B. And the nature of the perks themselves sometimes took an interesting form. For example, Atlanta offered over $2B in total incentives. Obviously there were tax incentives, but the bid also included perks like state-funded training programs, dedicated parking spaces and an Amazon employee lounge at the airport, and a dedicated MARTA car.

- Depending on measurement method, Brookings Institute estimates that total spending on economic development incentives ranges from $45 – $90 billion annually.

Even if your goals are a more modest regional office, the economic benefit may be smaller but there’s still a benefit. These cities can serve as both potential tech talent pools and as an opportunity to lower the cost of living for existing employees interested in living away from your current hub.

Keep in mind that the optics haven’t been all good for the winning cities. There has been a fair amount of blowback around both the process and the decision, including complaints that:

- the bidding process lacked transparency for constituents (and sometimes legislators) as to what incentives were being offered

- Amazon was given access to a great deal of non-public information around infrastructure and economic roadmaps across the country through the bids

- Amazon pitted metro areas against each other, pressuring Seattle lawmakers and potential HQ2 hosts to extract economic incentive packages and favorable tax treatment

- the selected cities will face upward rent and real estate pressures

Realize you may encounter a ‘once bitten, twice shy’ sentiment amongst officials around courting tech vendors with economic incentives. Approach these conversations as a partnership rather than a hostage situation.

Opportunities to Partner

‘Traditional’ companies are increasingly doing interesting things in technology across the country. For example, Target is running their own dojos to help teach other companies their techniques in Minneapolis. Kroger is working hard to forge digital pathways in Cincinnati. There are most definitely opportunities for deep and meaningful partnerships between technology companies and other industries, and technology vendors should be on the lookout for these cross-industry opportunities.

There is also an opportunity for gaining developer mindshare. We often have clients ask how to maximize the utility of their event spending. While there are some instances where this means sponsoring major conferences, we often advise that a large number of smaller investments can go a long way.

You’ll find active tech communities in these cities that would embrace your support. Consider:

- sponsoring the project showcase night for a local coworking space

- forging relationships with the local code schools; are there opportunities to both improve the quality of student experiences while also building yourself a hiring pipeline through your partnership?

- looking up the local meetups that support the technologies you care about, and sponsor their dinners for a year

Tech talent exists outside the traditional tech hubs. If you are interested in making connections, please reach out to the RedMonk team. We’re happy to help play match maker and help connect companies and communities where we can!

Disclaimer: AWS is a RedMonk customer.

Scott P Duncan says:

November 19, 2018 at 6:20 am

All this is likely what these cities should have done in the first place rather than try to court Amazon.