This edition of By the Numbers is comprised of figures that initially intrigued me but for various reasons became things I was hesitant to highlight. I was originally going to scrap the whole post until a great conversation this week about “showing your scar tissue.” In the interest of practicing what we preach, I’m pushing through some of my reservations and hitting publish anyway.

(Photo credit: Flickr/morebyless under CC-BY 2.0)

$17.8B*

Online retailer Alibaba boasted its largest ever ‘Singles’ Day’ shopping event last week, selling RMB 120.7B in gross merchandise volume on 11-11-16.

How much is that in U.S. dollars? Great question, and the answer depends on which outlet you ask. The consensus ranges between $17.7B – $17.8B, with various reputable sources showing values at $17.7B, $17.73, and $17.8B. While these discrepancies are likely attributable to using different exchange rates for the conversion, it’s problematic because 1) the figures become even more convoluted once outlets begin reporting growth rates using disparate absolute values over multiple years and 2) it seems worth noting when $100,000,000 becomes a rounding error.

Discrepancies aside, what is even more concerning are the wider questions into the validity of the gross merchandise volume figure in the first place. The SEC initiated an investigation into Alibaba’s financial reporting techniques in May that includes their GMV calculations. The investigation is still ongoing and the SEC allegedly has the cooperation of at least one ‘high-up’ whistleblower (though the company denies there is “any factual basis” to that claim.)

Critics of the gross merchandise volume figure state that GMV “isn’t defined under accounting standards and doesn’t include products returns.” There are also concerns that the figure includes canceled orders or other methods that otherwise inflate the figure, and that the number doesn’t accurately reflect the financial position of the company. Even Alibaba agrees that GMV “doesn’t represent our true identity” and is working to downplay the number.

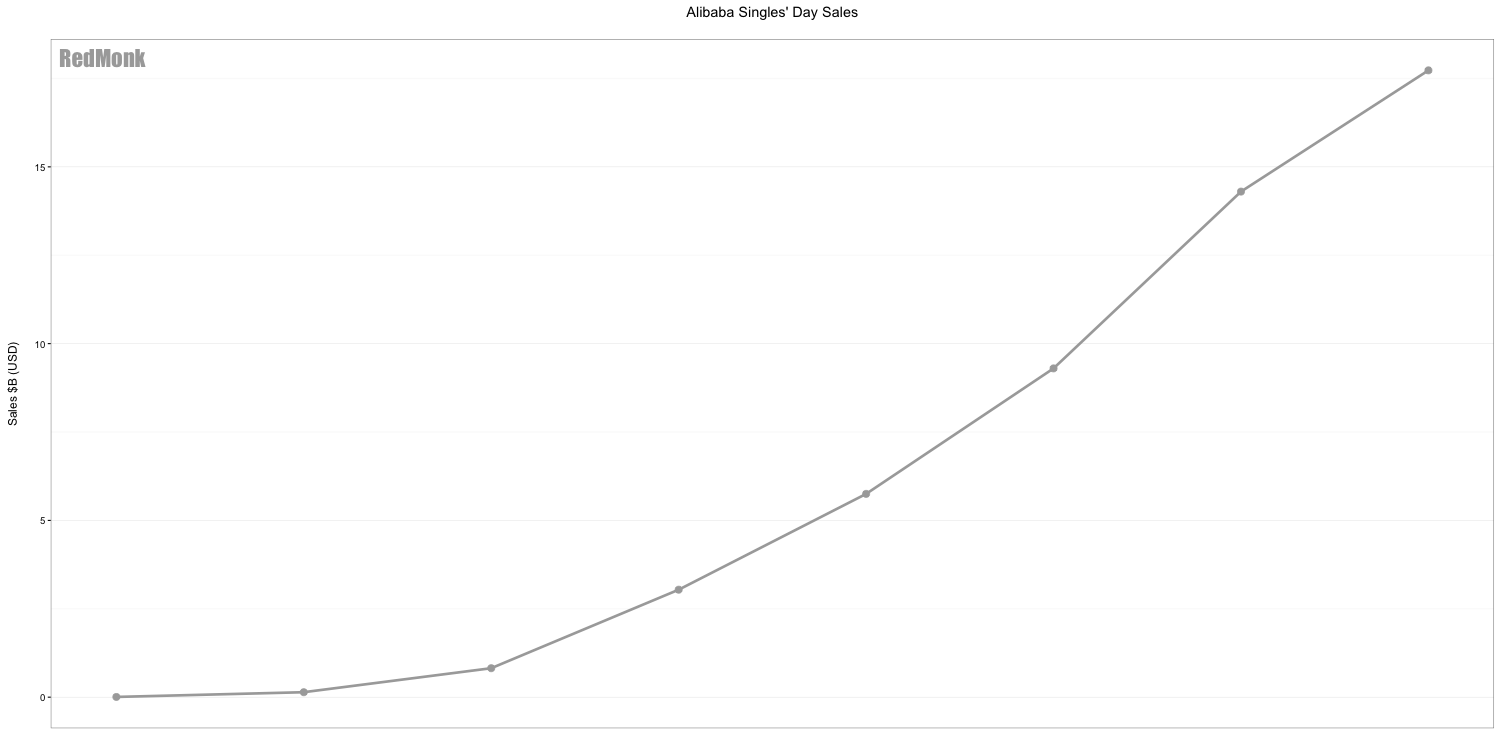

Factoring in the above caveats of USD discrepancies and the questionable value of the GMV figure itself, here’s how it’s grown since the event’s inception in 2009. Even if the numbers themselves are dubious, I still find the trajectory interesting.

$600M

Giphy raised a $72M round of capital, indicating that the company is valued at $600M. This doubles the company’s projected value from its $300M valuation during its last funding round in February.

The ultimate reason this number is ‘scar tissue’ is that I feel utterly unqualified to provide worthwhile commentary on the world of venture capital. How is the company worth twice as much as it was just a few months ago when the company has yet to earn any revenue at all? I’m not sure I’m the right person to answer that. I’m not an expert; everything from here forward is me sharing an ongoing learning process.

User growth seems to be the oft-sited driving force behind the valuation. Giphy’s 2016 State of the GIF claims that it serves one billion GIFs per day to over 100 million daily active users, totaling two million total hours of GIFs viewed daily.

A billion gifs a day served by @giphy. That's crazy. #FS16sf pic.twitter.com/i8KhhVPEOp

— Richard Seroter (@rseroter) November 17, 2016

Beyond just user growth, Giphy COO Adam Leibsohn justifies Giphy’s valuation “because of its ability to reach billions of people through the networks it has partnerships with.” He speaks of the power of the underlying search engine, the company’s APIs, the partnerships for both generating and distributing content, and the rising value of GIFs as a medium.

From that perspective, the basis of the valuation starts to sound a little bit less than the value of ‘eyeballs’ and more like a the value of a network effect. Network effects move beyond viral growth and instead speak to a virtuous cycle where an increase in the user base increases the value of the service itself.

Can we argue that more Giphy users is creating a network effect? I think so. More users means there are more people uploading content. More content means more reason to use the service. More demand for the service increases the desire to partner, which increases the ease of using the service, which increases use of the service, which increases the user base, which helps grow the content, etc. If Giphy can generate a network effect, it will serve as a competitive advantage and will theoretically empower them to monetize in the future.

And how does that all tie to Giphy’s latest round of funding? I’ll close with an excerpt from Tren Griffin’s post, A Half Dozen More Things I’ve Learned from Bill Gurley about Investing.

Since there is no way to predict when the spigots supplying new cash will be less available or even dry up and since network effects are so critical, a technology startup or business must, as Bill Gurley says: “play the game on the field.” The entrepreneur must trade off: (1) the risk of running out of cash against (2) the risk of not acquiring essential network effects before more free spending competitors do so. There is no scientific method for optimally making this tradeoff. However, cash in the bank is something that can give the business a margin of safety. A famous investor once called cash “financial Valium.”

It seems from this point of view, the $600M is the wrong number to focus on. Instead, the story should be about how the $72M in funding will help Giphy build their network effect. Or (not to get too Ben Horowitz on you):

No Comments