Artificial intelligence (“AI”) can be a loaded term. It simultaneously carries the unfulfilled promises of AI winters past with the dreams of science fiction futures. There is undoubtedly hype, but there is also justified excitement about the underlying technological progress and promise. On top of all these seeming contradictions, there is ambiguity in the language we use to discuss AI; there are a bevy of related terms (e.g. AI, machine learning, deep learning, cognitive computing) that are frequently used inconsistently and/or incorrectly.

Frank Chen of Andreessen Horowitz views artificial intelligence – and in particular deep learning – to be a technological shift that will be “as profound and maybe even bigger” than the recent platform shifts to mobile and cloud. Though AI has arguably existed for 60 years, it is still early days in terms of using it in production/commercial capacities. While companies are motivated to put their existing data to better use, many are still grappling with how and when to implement an AI solution.

The nominees for ‘Most likely to be suggested as inappropriate solution to a complex problem’ are:

🏅Blockchain

🏅Chatbots

🏅Machine learning— Cat Lady (@NatDudley) October 31, 2016

The Expanding Reach of AI

Given that the AI market is both widely misunderstood and also strategically positioned for tremendous growth, the recently announced Partnership on AI is an unsurprising development. Amazon, Google, Facebook, IBM, and Microsoft jointly established an organization to clarify AI best practices, engage relevant stakeholders, and facilitate a dialogue around the technology. The partnership offers the opportunity to build the market and shape perceptions.

While collaboration can help grow the pie, companies are aggressively developing their own AI research capacity. Here’s a small sample of the AI ambitions of companies both in and out of the partnership:

- Facebook is attempting to build “the best AI lab in the world” to improve content for its users. (Reminder: its monthly active user base is more than 1/5 of the global population.)

- To wide acclaim, Google’s neural network-powered AlphaGo beat the world’s top Go player in March, a feat that was hitherto thought impossible.

- Amazon is now offering a $2.5M Alexa prize to teams that can build a socialbot that can converse for 20 minutes.

- Despite their chatbot missteps earlier in the year, Microsoft CEO Satya Nadella states “AI is at the intersection of our ambitions” and recently formed an “AI and Research Group” to support these goals.

- Baidu has an AI lab that aims to “have a significant impact on the lives of at least 100 million people.”

- Apple’s Siri is handling “2 billion requests a week” according their latest earnings call.

- Salesforce’s Einstein is bringing the company’s ’no software’ mantra to AI with the goal of making CRM AI “available for everyone.”

- While Elon Musk has a decidedly more cautious position on the direction of AI, in December 2015 he co-founded the non-profit OpenAI with the goal of democratizing the power of AI. The organization’s intent is to ensure the power of AI is broadly distributed and not concentrated in the hands of any single corporation.

This represents an immense amount of resources going towards AI, and the above is just a limited sample of development efforts at a limited selection of organizations.

To give additional scope, it should also be noted that companies are tackling the process of building R&D capacity with both ‘make’ and ‘buy’ solutions. CB Insights estimates that there have been over 40 acquisitions of AI startups year-to-date, and the pace of these acquisitions has quickened in recent years.

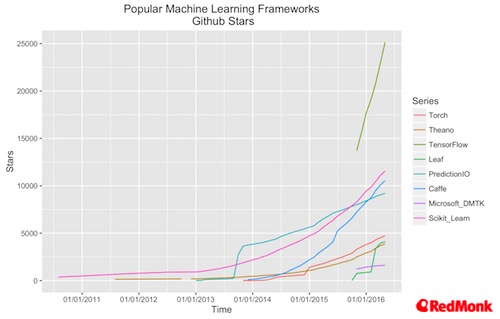

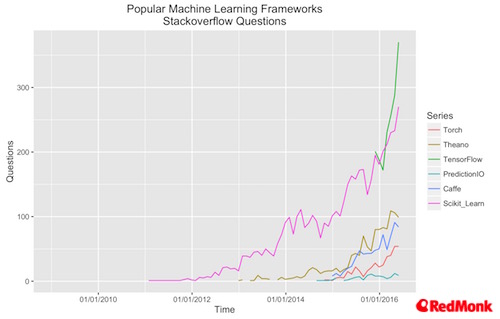

Finally, there is also grounds-up adoption of AI tools amongst developers. My colleague Fintan recently looked at the relative traction of machine learning open source frameworks and found that “at last check there were well over one hundred and twenty different machine learning/deep learning frameworks available.” Here are his findings about traction amongst the most popular.

If these are taken all together as indicators of market direction, then we should expect the potential scope and prevalence of AI to be vast.

IBM’s World of Watson

Last week IBM hosted their World of Watson conference for 17,000 attendees from October 23 – 27, 2016. The show was formerly coined ‘IBM Information on Demand’ and more recently ‘IBM Insight,’ but this year the event was all about their AI tool Watson. Though IBM’s Watson has been in the public eye since its 2011 Jeopardy victory, cognitive solutions have been and will continue to be a long-term ramp for IBM. That said, some exciting developments were on display at World of Watson. Or more succinctly:

so we’re seeing bona fide swagger from both @IBM and @microsoft this week #ibmwow #MicrosoftEvent this is good for the industry.

— Shaker Boy (@monkchips) October 26, 2016

In both in their product and partnership announcements (including Slack, GM, and Ricoh amongst others) it is evident that IBM is focused on commercializing Watson’s conversational APIs. This effort is particularly perceptible in IBM’s new Watson Work offering, a service designed to use AI to augment the office communication and workflows.

Also of note, IBM announced their simplified cloud offering. They consolidated disparate brands and streamlined Bluemix’s usability. While this may seem distinct from the Watson announcements, CEO Gini Rometty said in her keynote, “cognitive and cloud are two sides of the same coin.”

In aggregate, IBM’s 2016 World of Watson announcements were a stride towards making AI both commercially available and interesting to the average enterprise.

Show Me the Money

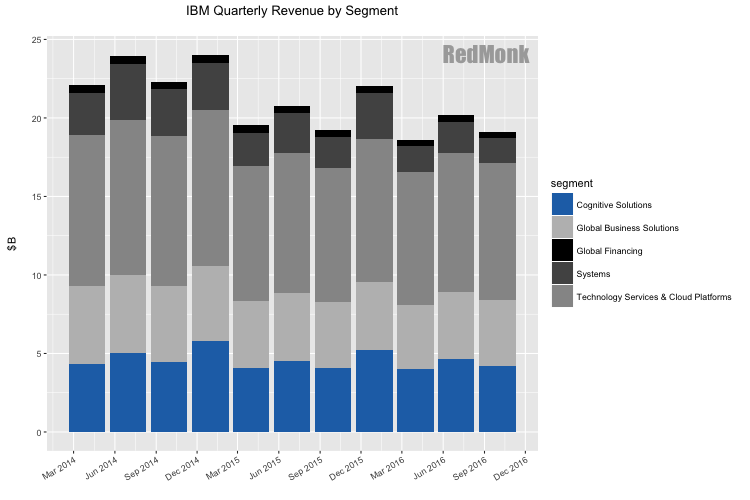

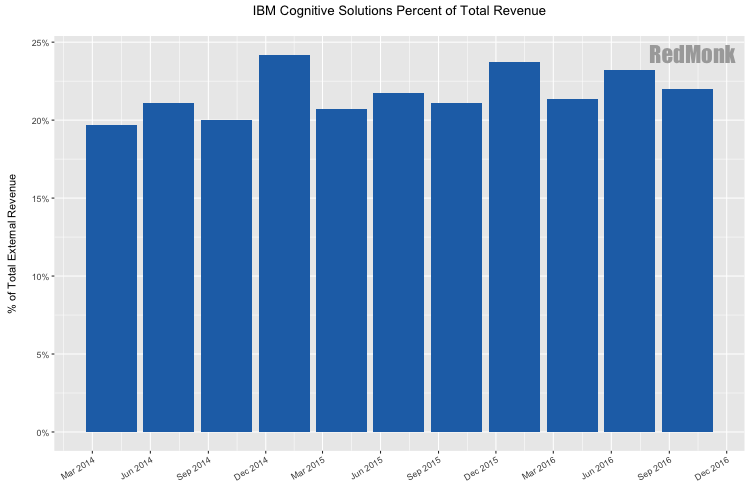

While we believe that AI will be a dominant market segment, it’s current financial impact is rather opaque. Of the public companies above, IBM comes closest to providing a view into AI’s impact on the company’s income statement. IBM changed their reporting segments to explicitly break out “Cognitive Solutions” at the beginning of 2016. With the YTD figures from 2016 plus the restated figures provided for 2014-2015, we now have almost three years of trend data for the segment.

Despite IBM’s increased focus on becoming a “cognitive solutions and cloud platform” company, it’s interesting that so far cognitive revenue has remained relatively flat both in terms of absolute dollars and percentage of total revenue.

While this is obviously reflective of IBM’s performance, this is also in part a function of the nascent AI market. When asked about Watson’s revenue in Q3 2016, CFO Martin Schroeter said, “keep in mind that we’re also building new markets here and it’s going to take some time.” The creation of the AI market is well underway at IBM and elsewhere, and it will be interesting to watch how competitors in the space are able to both grow and monetize it.

Disclaimer: Amazon, IBM, Microsoft and Salesforce are current RedMonk clients. IBM comped my conference ticket and hotel for the World of Watson conference.

No Comments