RedMonk hosted our annual ThingMonk conference from September 12-14, 2016. ThingMonk is devoted to the Internet of Things. We spent three days discussing IoT platforms, both industrial and consumer IoT, IoT-driven analytics, and numerous views on how IoT is evolving. The event also included skills workshops and a non-competitive hack day.

ThingMonk was warmly received, partially due to London’s unfortunately timed September heatwave (puns!) but primarily because the conference facilitated interactions between a fantastic group of people both on and off the stage.

James and Fintan were kind enough to have me speak about the economic drivers of IoT. Tracy Miranda also graciously offered me the opportunity to give a condensed version of the talk at a Women Who Code event while I was there.

. @rstephensme sharing the economics of iot @WWCLondon @coedcode @EclipseIoT pic.twitter.com/8uJsQti5OS

— Tracy Miranda (@tracymiranda) September 14, 2016

If you have any interest in watching my presentation here’s the video.

While I loved sharing my research, I’m definitely going to have to work on my ‘don’t panic!’ stage presence (this was my first ever talk at a conference!) As promised, here a written overview of my findings follows for those who prefer reading over speed listening.

Overview

My talk covers three main areas:

1. the concurrent forces that have acted together to become the economic enablers of IoT

2. how these enablers are leading to IoT ubiquity

3. how current investments are poised to shape that market.

tl;dr

Numerous concurrent economic enablers for components leads to impending ubiquity of IoT. There is a growing consensus around potential market size, which is driven by the diverse investments being made today.

Component Economics

Sensors

IoT is the digitization of the physical world, and the sensors that measure the state of the world are a crucial element of the system. In recent years we’ve seen drastic improvement in sensor technology. A wider variety of sensors exist, their capability continues to increase, and their sizes continue to decrease.

On top of the improved performance, average costs have dropped considerably. Goldman Sachs estimates that an average sensor that cost $1.30 a decade ago now costs only $0.60 today.

Improved performance and cost reductions create more technically and economically viable use cases for sensors. The sensor market is expanding; that same Goldman Sachs report finds that sensor sales are now outpacing sales in the overall semiconductor market.

One attendee shared Q&A feedback that they have not seen the falling cost phenomenon in the sensors they use. While averages can tell a mathematically-compelling story, we do have to be careful in how we apply them. There are undoubtedly some sensors do not fit this model at this time. RedMonk is excited to continue exploring this trend with more granularity, and I welcome any data points you have anecdotally or otherwise about what you’re seeing in the sensor market.

Batteries

Ensuring devices have a reliable power supply is a crucial aspect to IoT. Batteries are often — though not always — the source of that power.

Batteries have widely been considered to be a limiting reagent of IoT, as it has proven to be technically difficult to improve battery density and battery duration simultaneously. While Moore’s Law has shown processing power doubling every 18 months, some estimates put annual improvement in battery performance at a much more modest 5%/year.

Though battery fires have dominated the news cycle recently, the bigger picture shows that we have made tremendous strides in developing battery production overall. As more companies work to develop and share battery technology, we expect continued economies of scale to emerge in battery production. Financial analysis firm Lazard Research projects that in the next five years, the capital costs for production may decline by up to 50% for lithium ion batteries, 40% for flow batteries and 25% for lead batteries. Capital costs are only a portion of the equation and this is only a single opinion, but it is interesting to consider the potential direction of the production system.

Bandwidth

You can’t have an internet of things without the ability to network all the edge devices together. I tried to find raw data about the cost of bandwidth, but I’m fairly convinced it’d be a full-time job to try to unwind all the data between different networking methods, especially once you factor in costs across different countries and carriers. (That said, here is a data set that collects mobile and broadband costs across a sample of international cities. I ultimately didn’t incorporate it into my talk, but it may prove useful for those who are interested in exploring this further.)

I did, however, find yet another interesting data point from Goldman Sachs that estimates the cost of bandwidth overall has fallen by a factor of 40x in the past decade. The ability and cost to connect devices has fallen substantially.

Compute

The promise of IoT is in more than building connected devices, but rather in turning that data generated by these devices into actionable information. To do that, we need the ability to process and store the data both centrally and at the edge.

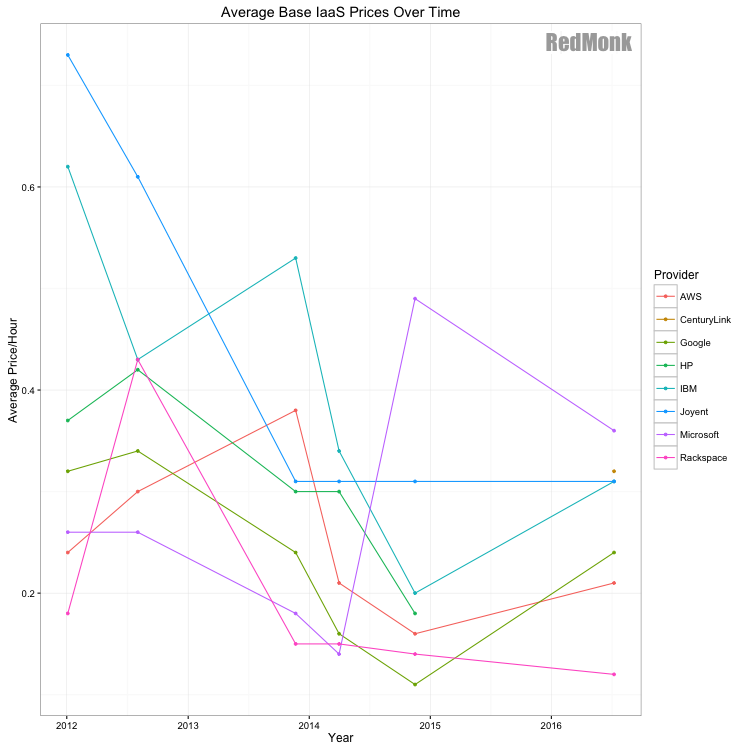

Though there are indications that we are reaching its limits, Moore’s Law has been a key driver behind the falling cost of compute for the last 50 years. The declining cost of hardware for on-prem servers has been well-documented, and we at RedMonk have done research to show the average cost of a base cloud instance has fallen across virtually every cloud provider over the past five years.

Open Source Software

The ability to handle data is similarly enhanced by the unprecedented availability of open source software. As Steve said in The Software Paradox, “the number of software categories without a viable open source choice is growing smaller by the day.” Up and down the stack and across the IoT network, open source is increasingly prevalent. As evidenced by the talks at Eclipse Day, there are numerous examples of open source options already being used for IoT implementations.

Open source makes IoT both economically-viable and developer-friendly. While this is not a phenomenon unique to IoT, the trend toward more open source software is definitely an economic enabler of IoT growth.

Market Size

While the above components are not a comprehensive list of economic drivers, in aggregate they are driving the cost of IoT lower. Lower costs enable the proliferation of IoT technology. RedMonk doesn’t traditionally do market sizing, but it’s worth looking at some consensus numbers to see what the general projections are for market growth.

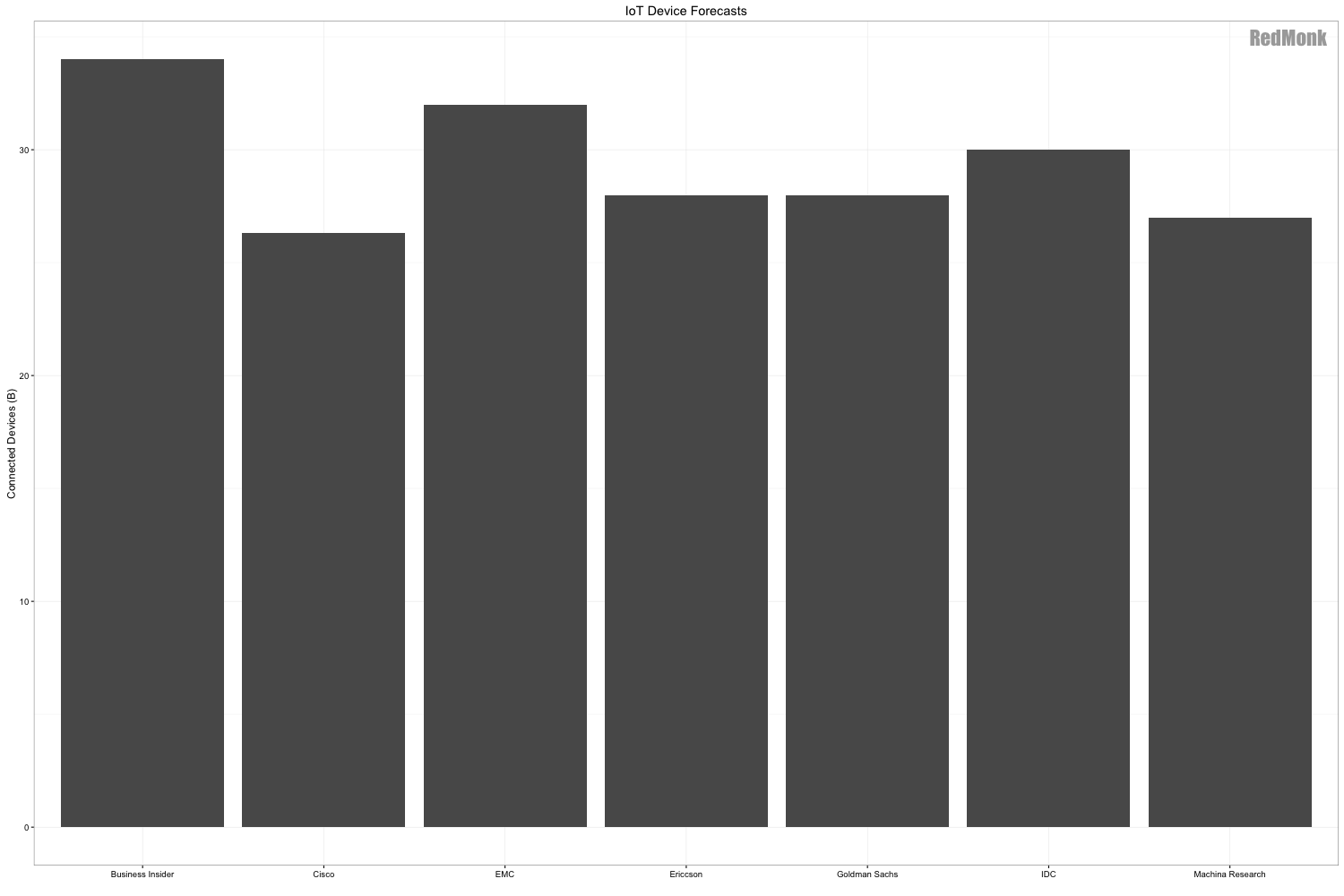

The consensus average shows that we should expect something in the neighborhood of around 29 billion devices worldwide between 2020 and 2025. If device forecasts and population forecasts hold, in 2025 connected devices will outnumber humans more than 3:1.

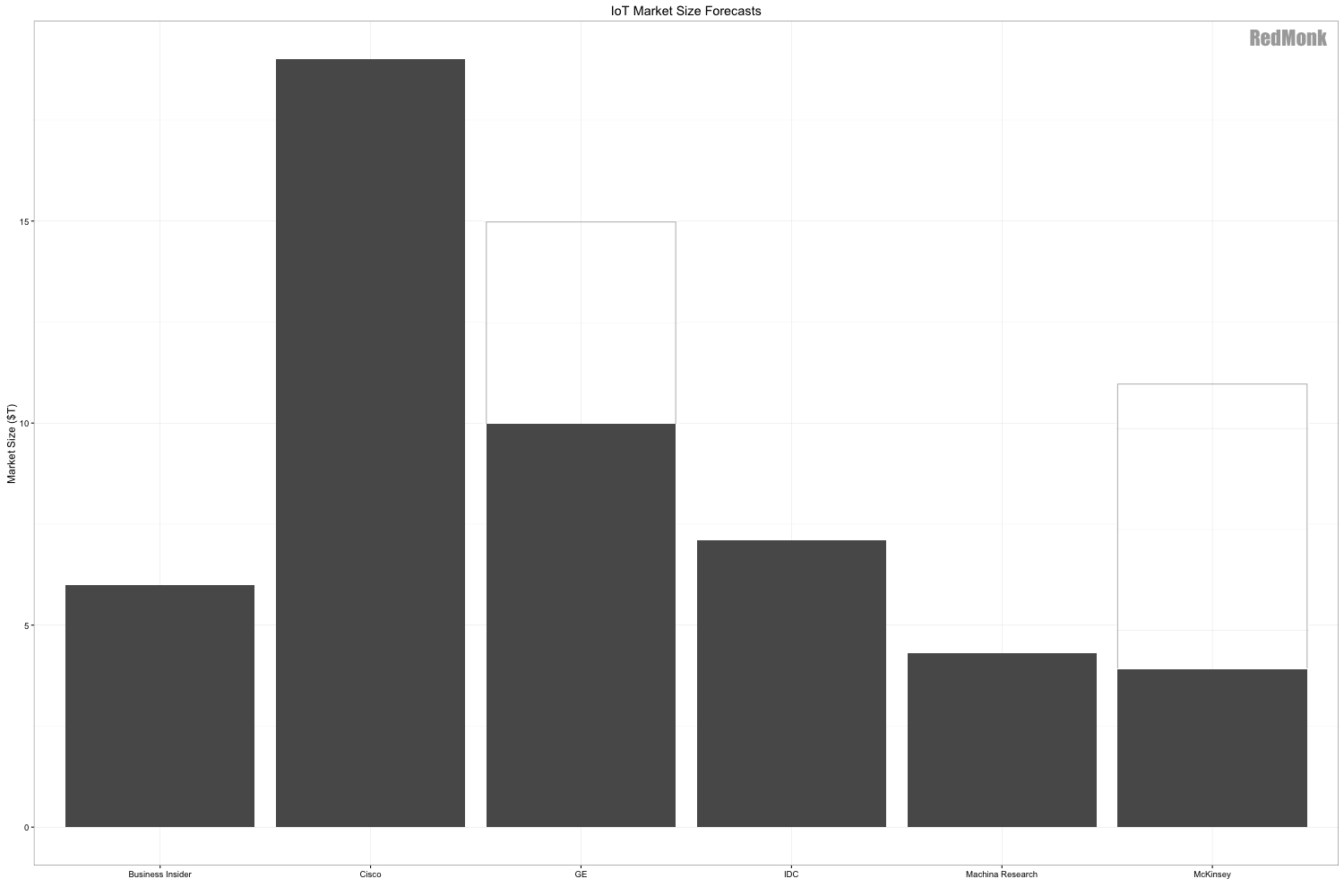

Estimates of market value are wider ranging than the device forecasts, both in terms of dollar amount and timelines. it’s more difficult to draw a clear consensus from such disparate estimates, it’s clear that IoT will create several trillion dollars of economic value in the coming decade.

Sources: Business Insider, Cisco (devices), Cisco (dollars), EMC, Ericcson, GE, Goldman Sachs, IDC, Machina Research, McKinsey

Current Investors

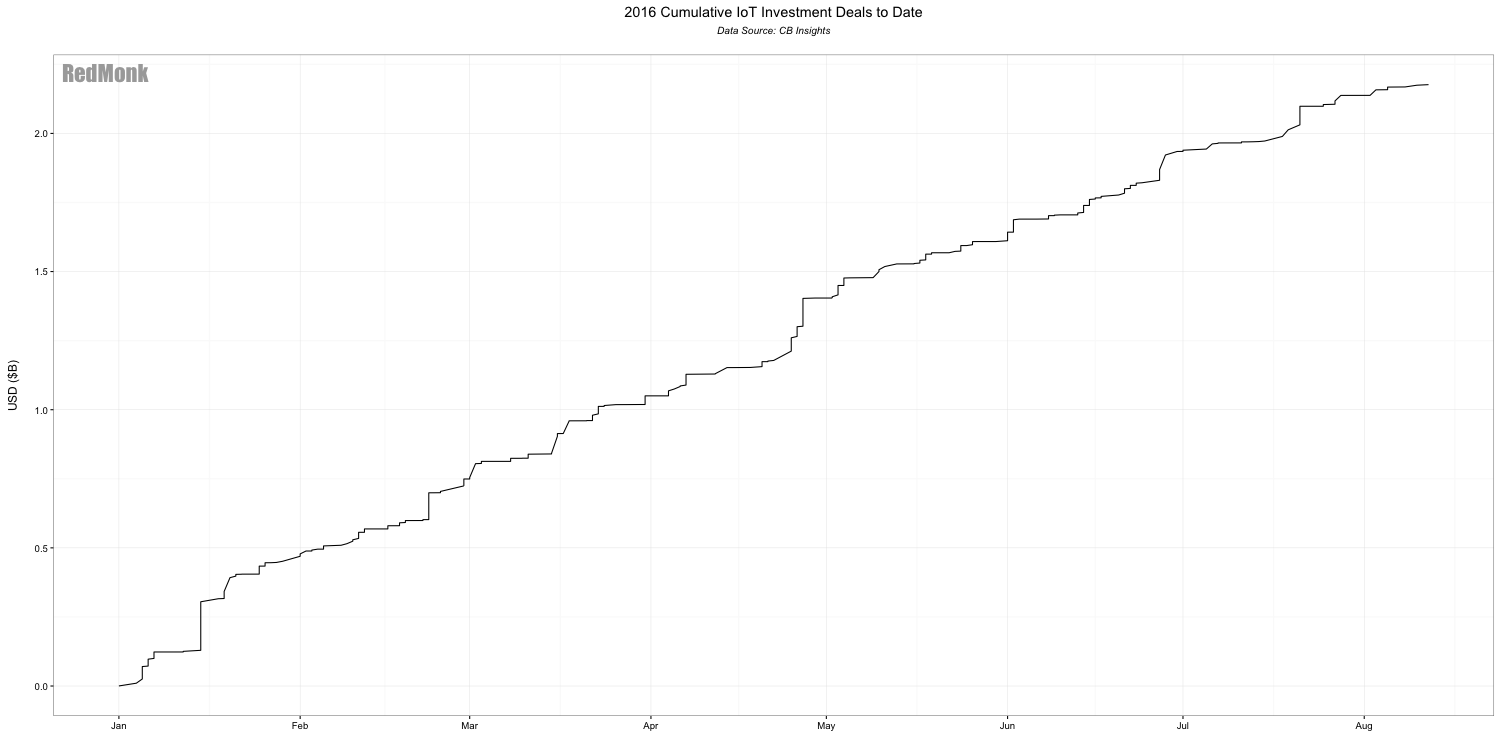

We expect the market to be large, but what investments are being made today to support the growth in that market? This portion of the talk used a CB Insights dataset of 350+ investments made in IoT-based startups from 2016 to examine potential investment trends.

As a caveat, this dataset is assuredly not comprehensive and I do not assert that this captures all the investments being made in this space. This is not a holistic picture around IoT investment, but rather a data point that helps tell part of the story.

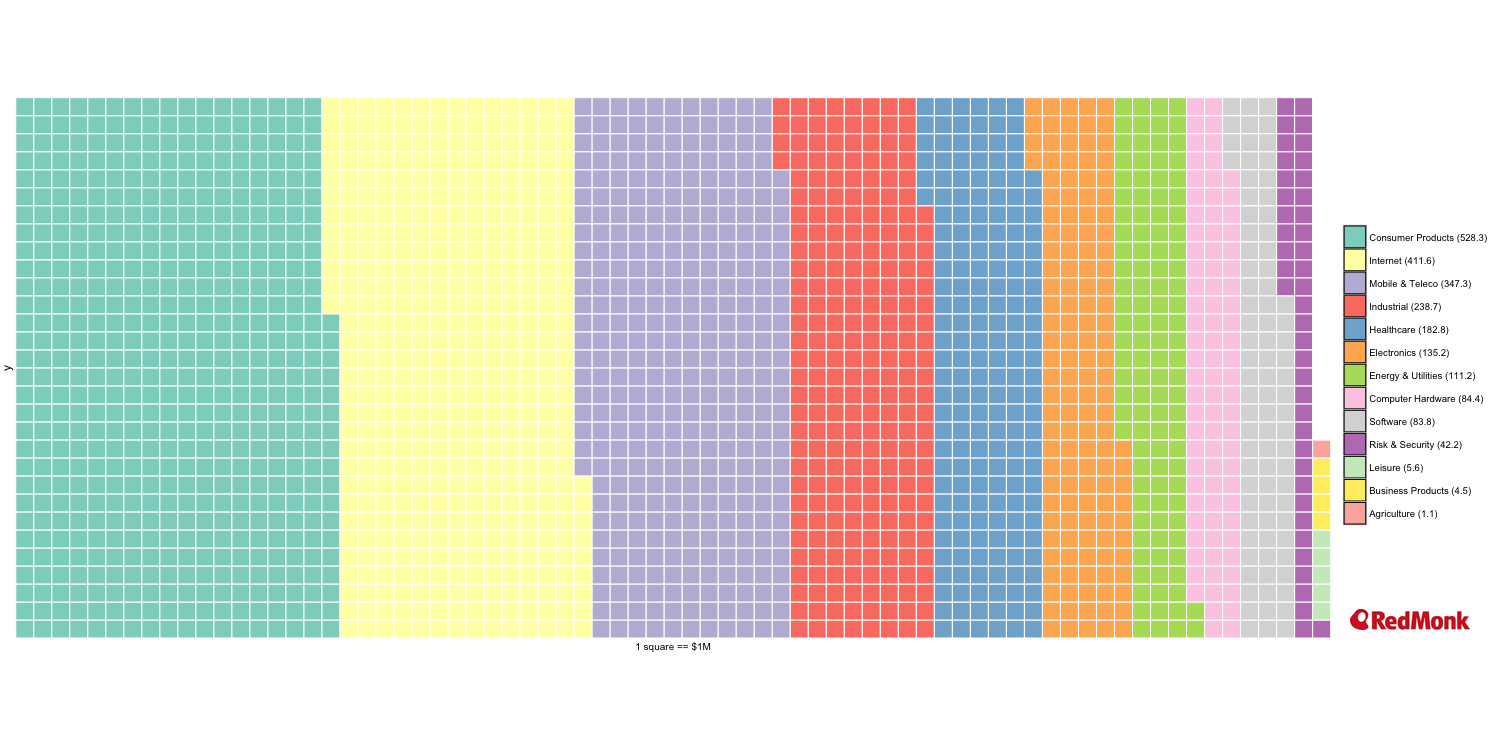

That said, investments made just in this subset alone already total over $2B invested between January and August 2016.

These investments are being made in nascent companies, with over 50% of investment dollars going to accelerators, seed rounds, or series A. The investments are being made in a diverse set of industries and verticals.

It is also notable that consumer products is currently the singular dominant sector in IoT investments, accounting for 24% of investment dollars so far this year. While B2B sectors are larger in aggregate, it’s interesting to see C2B receiving this much investment attention given that B2B is both a bigger market and is widely considered to be the leader in IoT adoption.

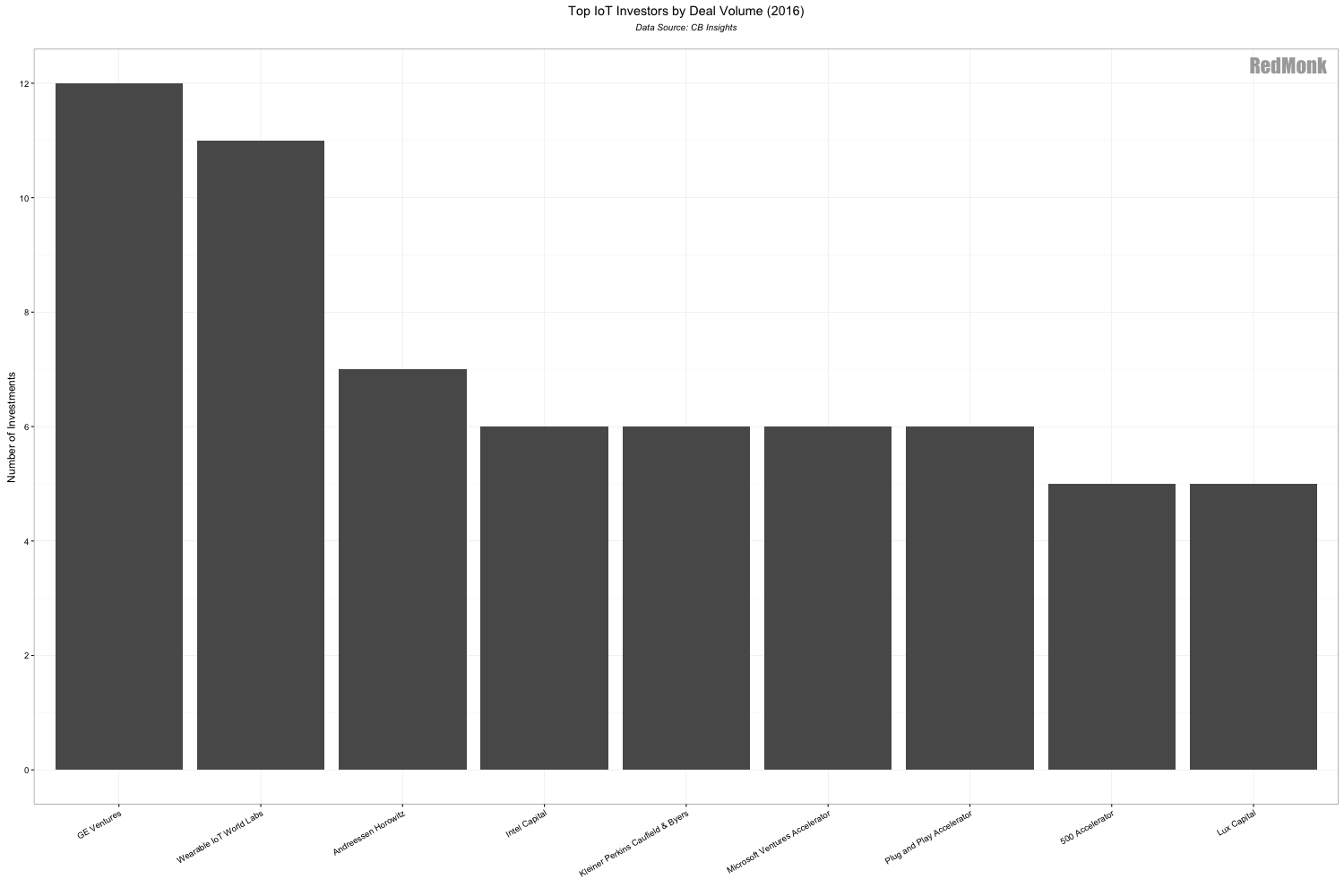

Finally, it’s interesting to look at the source of funds. This chart shows the number of deals executed by the top named investors. These 9 investors can be categorized into three groups: startup accelerators, VC and investment funds, and existing industry. While these investors all share the desire to make successful investments in IoT startups, their approaches and motivations all arise from very different business needs. We can expect their investment approaches to vary accordingly.

Conclusion

Economic forces are acting upon IoT components and driving costs down. As costs go down, it becomes economically more feasible to pursue a wider variety of use cases, which enables the proliferation of IoT technology. We expect the market to grow substantially both in terms of the number of devices and the market value. Based on investments that are happening today we expect that this growth will be seen in a diverse set of industries and will be driven by a diverse set of investors.

No Comments