The prevalence of cloud compute continues to grow since our last update of infrastructure as a service pricing, and the competition amongst cloud providers remains intense. ‘Hybrid’ and ‘multi-cloud’ are the buzzwords du jour. However, it can be difficult to properly assess how competitive cloud providers are with one another because their non-standardized packaging makes it effectively impossible to compare services on an equal footing.

To this end we offer the following deconstruction of IaaS cloud pricing models. This analysis is intended not as a literal expression of cost per service; this is not an attempt to estimate the actual component costs for compute, disk, and memory per provider. Such numbers would be speculative and unreliable, as they would rely on non-public information. Instead, this analysis compares base, retail hourly instance costs against the individual service offerings.

What this attempts to highlight is how providers may be differentiating from each other via their pricing models. In other words, it’s an attempt to answer the question: for a given hourly cost, who’s offering the most compute, disk or memory?

As with previous iterations, a link to the aggregated dataset is provided below, both for fact checking and to enable others to perform their own analyses, expand the scope of surveyed providers or both.

Before we continue, a few notes.

Assumptions

- No special pricing programs (beta, etc.)

- No operating system premium. Prices are based on Linux OS.

- No reserved/committed use instances. Charts are based on virtual machine price/hour costs.

- No specialized packages (i.e. no high memory, etc.)

- Prices are based off the lowest cost US-based region.

Objections & Responses

- “This isn’t an apples to apples comparison.”: This is true. The providers do not make that possible.

- “These are list prices. Many customers don’t pay list prices.”: This is also true. Many customers do, however. But in general, take this for what it’s worth as an evaluation of posted list prices.

- “This does not take bandwidth and other costs into account”: Correct, this analysis is server only. No bandwidth or storage costs are included. Those will be examined separately.

- “Why isn’t price/hour on the y-axis instead of x-axis?” That’s absolutely a valid way to view the relationship between these variables, but in this analysis we’ve made a deliberate choice to frame cost as the independent variable to explore the question from the perspective of ‘given $x, how much disk/memory/compute can I get from each provider?’

- “This survey doesn’t include [provider X]”: The link to the dataset is provided. You are encouraged to fork it.

Notes About Vendors

- Joyent (dropped in the Q2 2017 iteration and re-added Q2 2018): Public pricing data was removed following Joyent’s acquisition by Samsung in June 2016, but they have resumed publishing pricing information as have been re-added to the analysis accordingly.

- Oracle (added as of Q2 2018 iteration): Oracle has simplified its pricing structure to offer true metered instances with no minimum commitments on time or spend and are now included in the analysis.

- Alibaba (added as of Q2 2018 iteration): We added Alibaba after an uptick in interest in our conversations with developers, partners, and cloud customers.

See vendor notes from previous iterations in the footnotes. 1

Notable Changes to Offerings

- It’s a balancing act to attempt to maintain historic comparability of this analysis while also representing the ever changing offerings from competitors. In particular, AWS and Microsoft have moved the products we were previously analyzing to “previous generations” and have introduced new offerings. We continue to show previous generation offerings (AWS m1/m3 and Microsoft D series v1) for historic context, but we’ve also added in current generations (AWS m5d and Microsoft D series v2) to allow for comparisons of current offerings across providers. Note that AWS’ m5d.24xlarge instance is excluded from the analysis, as in both available resources and price its approximately 2x larger the next nearest shape (which in most cases is AWS m5d.12xlarge.) We will continue to watch the trend of larger instances, but for now it’s an outlier that we’ve excluded.

- IBM previously permitted users to configure servers but have now switched to having users select from pre-built options. Unfortunately this change means we’ve lost apples-to-apples comparability with previous price points for IBM, as the precise builds we used previously are in many cases no longer available for purchase.

- Both Oracle and IBM had pricing structures that offered multiple shapes for the same price point. (For example, Oracle offers a shape with 7GB of memory for the same price as an otherwise comparable instance with 15GB of memory. IBM prices the same for shapes with 25GB and 100GB of disk space.) In these circumstances, we only take the most competitive shape into consideration.

IaaS Pricing

A quick note on how to read the charts: the simplest explanation is that the steeper the slope, the better the pricing from a user perspective. The more quickly cores, disk, and memory are added relative to cost, the less a user has to pay for a given asset.

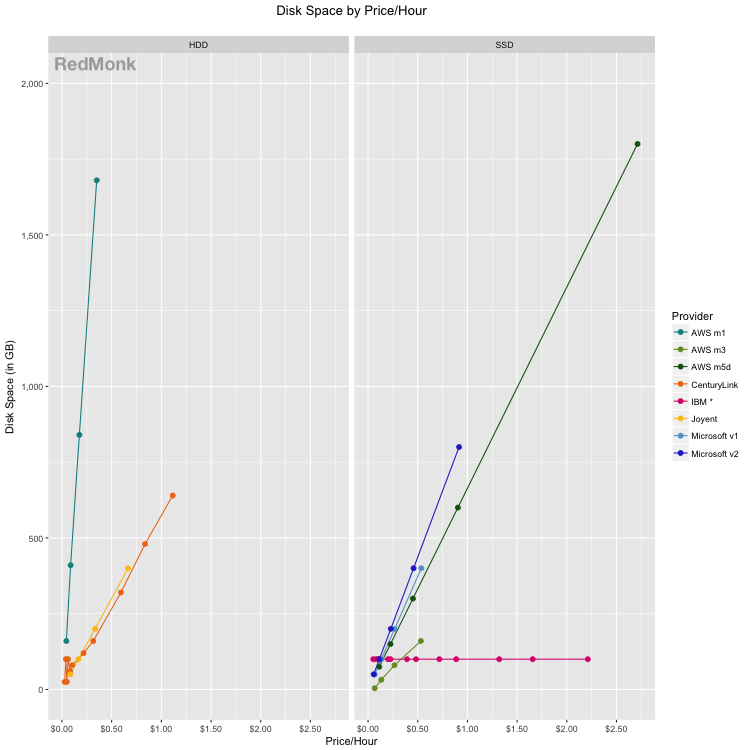

With that, here is the chart depicting the cost of disk space relative to the price per hour.

We previously noted our expectation for providers to converge to SSD storage. As such, this iteration we opted to separate HDD and SSD offerings to get a better sense of trends across disk types. Based on the slopes of the lines, there is not a uniformly notable price difference between HDD and SSD pricing. It is, however, interesting to note the growing proportion of offerings that are SSD.

The primary story from this chart is that for many if not most providers, storage is not a primary focus from a differentiation standpoint.

- The most competitively priced product is AWS m1, a previous generation offering from Amazon. In terms of disk space per dollar, Amazon’s m5d current generation is competitively aligned with other infrastructure players.

- In early iterations of this analysis through 2014, Joyent’s storage offering competed head-to-head with Amazon; they dropped this aggressive posture in 2016, and their current pricing model continues to indicate storage is not an area of competitive differentiation.

- IBM’s flat line reflects their maximum offer of 100GB of storage in their base pricing. As their overall price increased for instances with higher compute and memory, there was no corresponding increase in disk space. It is asterisked because they are in the process of converting data centers to SSD and SSD availability is dependent on which data center location.

- Several providers do not include local storage in their base offering. Google and Alibaba require separate storage in their base pricing and thus are omitted from this chart. Oracle offers 1 PB of remote block storage with their offerings, which we excluded because that is a distinct and separate product line for most providers.

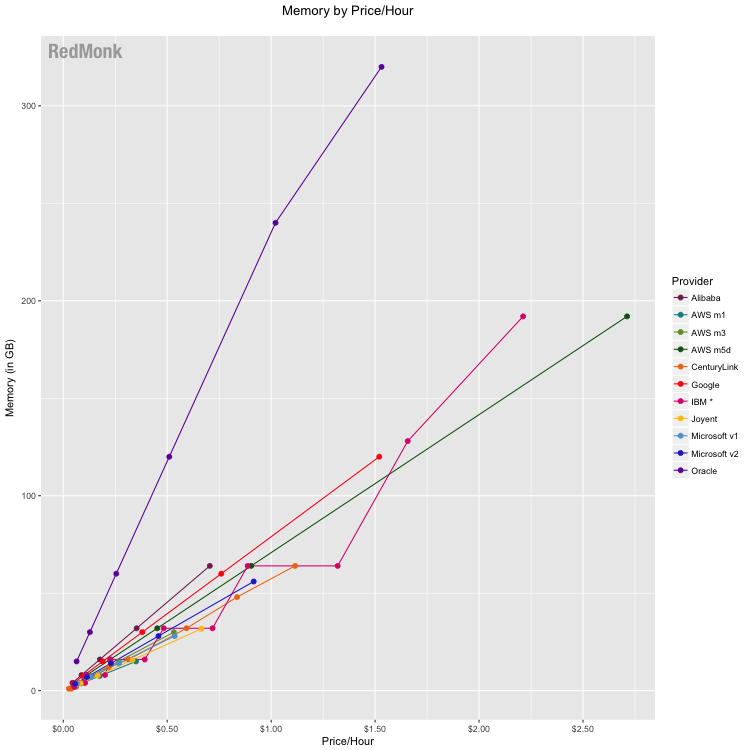

Competition between providers historically has not particularly differentiated in the context of memory per dollar, but the inclusion of Oracle and Alibaba changes this dynamic. Oracle in particular is pricing aggressively on this front, offering more memory per dollar across all of their instances. They offer roughly 2.5x more memory/dollar in their VM.Standard2.24 instance as compared to their next nearest competitor.

Alibaba also performs strongly in this metric, overtaking previous leader Google in terms of competitively priced memory. The other providers are competitively grouped, with varying rank order amongst the providers across their various instances.

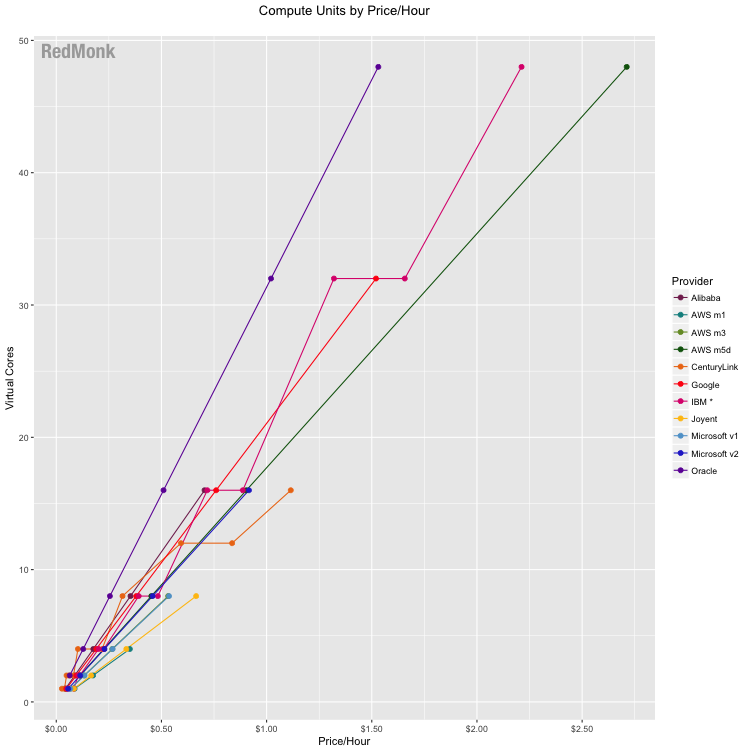

In the cloud, defining precisely what is meant by “CPU’ is complicated by the fact that unlike physical hardware, every cloud instance included here is powered by a virtual compute instance. In years past we attempted to compare available compute units rather than virtual CPUs, or vCPUs. As some providers have moved to stop providing explicit conversions in favor of treating vCPU implementation as a single hardware hyperthread, we have reevaluated the best way to provide an apples-to-apples comparison across providers. Without having direct visibility into a provider’s mix of physical hardware instances and how they map to available instance types, it’d be speculative on our part to try to estimate equivalent compute units. As such, we’ve fallen back on the most basic metric which we have access to, which is why the analysis now strictly compares vCPU.

According to Oracle, 1 of their OCPUs is equivalent to 2 vCPUs, and on that basis Oracle emerges as the pricing leader for compute, offering the highest amount of vCPU compute capacity per dollar spent. Other providers are clustered with no clear competitive standouts. This grouping continues to indicate that fewer providers are choosing to differentiate based on the pricing of their compute units.

IaaS Price History

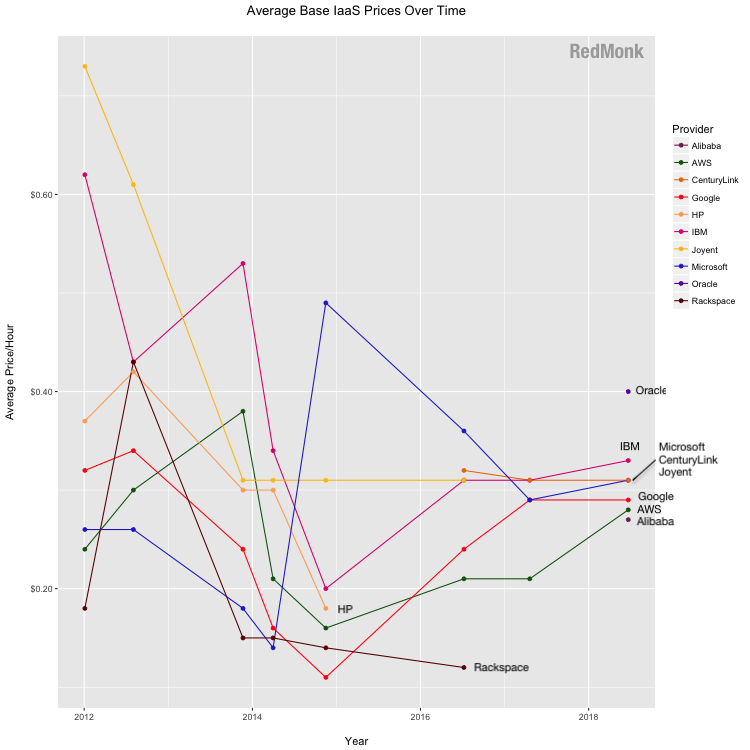

Besides taking apart the base infrastructure pricing on a component basis, one common area of inquiry is how provider prices have changed over time. It is enormously difficult to capture changes across services on a comparative basis over time, for many of the reasons mentioned above.

When we began tracking infrastructure pricing, available compute shapes commonly topped out at 16 virtual cores; now its common to see 32, 48, or even – in the case of the excluded AWS m5d.24xlarge – 96 vCPU. Historically we’ve attempted base the analysis on services that have been offered from the initial snapshot moving forward so as to be as consistent as possible. When the goal is to compare how providers are competing on price, it’s beneficial to control for changes to help isolate trends in price changes. Our pricing trend snapshots thus controls for larger instances, in this case defined as those that are greater than 16 vCPU.

Please keep in mind the objective of this chart: the intent is to understand price changes on a per provider basis over time, and it is less useful to attempt to compare average prices across providers. Services cannot be reasonably compared to one another in this manner because their available packages and the attached pricing vary widely. Some services included more performant, higher cost offerings initially, and others did not.

While this chart is less useful in comparing specific price points between providers as noted above, it is interesting to look at overall trends. A linear regression analysis continues to show downward pricing pressure in the industry. The trend line becomes significantly shallower after 2012 – 2014, and is now flattening out.

The vendor notes above and in the footnotes 1 provide additional context, but at a high level:

- HP’s history is included through 2014

- DigitalOcean and Rackspace are included through 2016

- CenturyLink was added 2016

- Oracle and Alibaba were added in 2018

- AWS and Microsoft includes new generation instances as of 2018

Implications

If you look back over the history of this analysis, you’ll notice a distinct shift in the commentary. In early years we spent a fair amount of time parsing the distinct patterns of the charts, as the different providers pursued different pricing strategies. There was a wider variability across the industry in terms of how much of each given resource (disk, compute, memory) was offered for a given price/hour.

In recent years, however, there has been a convergence amongst the industry. The offerings have become more clustered. There are fewer instances where a distinct pricing strategy for a given resource notably differentiates one provider from the others.

One interpretation of this development is that infrastructure is reaching a commodity status, and that there is less to be gained from price-based differentiation on base compute offerings. The picture painted by the average pricing trends support this view. The downward pricing pressure seems to have abated; when controlling for instance size, prices have largely leveled out or have even risen slightly. This indicates that while price is still important, it is no longer the primary point of competition. This does not indicate that competition in the IaaS space will not remain fierce, but it does have some implications about the form we can expect competition to take.

Disclosure: Amazon, DigitalOcean, Google, IBM, Microsoft, and Oracle are RedMonk customers.

Data: Here is a link to the dataset used in the above analysis.

-

Historic vendor notes:

– DigitalOcean (dropped as of Q2 2017 iteration): Droplets were one of the early cloud hosting options, and we originally stretched our definition of ‘apples to apples’ to include DigitalOcean as a reference point in the analysis. However, with the introduction of Amazon Lightsail in Q4 2016 we determined it’s best to begin breaking these VPS services out into a separate analysis rather than lumping them in here.

– Rackspace (dropped as of Q2 2017 iteration): At one time, Rackspace was one of the largest suppliers of hosted and managed infrastructure. Though they were once one of the early arrivers and main competitors in the space, Rackspace now partners with major players like Amazon and Microsoft rather than competing against them directly. Their pivot from supplying cloud infrastructure to supporting it is accelerating with their privatization in Q4 2016. While the company still offers their own hosting services, we determined that their new strategic direction indicates they are no longer a best fit for this IaaS analysis.

– HP (dropped as of Q3 2016 iteration): HP was previously included in this analysis, but was excluded following the announcement that they “sunset our HP Helion Public Cloud” in January 2016.

– CenturyLink (added as of Q3 2016 iteration): CenturyLink’s non-reserved price/hour fluctuates based on the number of hours used. We included their prices based on 720 hours/month as a point of reference. However, given that they don’t have a consistent hourly pricing model, this number should be taken with a considerable grain of salt in terms of its comparative value. ↩ ↩

Can Oracle realize its ambition to compete as a hyperscale cloud? says:

July 23, 2018 at 2:01 pm

[…] setting its pricing to be competitive. A new study by Redmonk analyst Rachel Stephens has looked at comparative hourly price points of the main cloud players and while I do have some caveats about the assumptions on which the study is based, it suggests […]

Oracle Cloud Infrastruktur – Seminarbeiträge zur Informatik says:

February 1, 2021 at 9:43 am

[…] https://redmonk.com/rstephens/2018/07/13/iaas-pricing-patterns-and-trends-2018/ […]