About Cribl

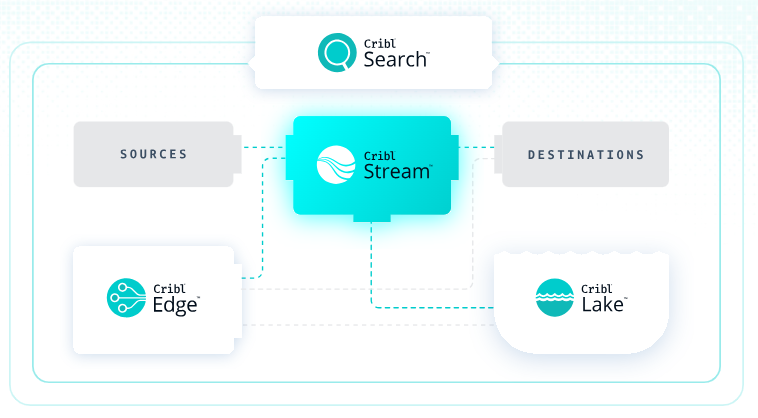

Cribl was founded in 2018 by Clint Sharp, Dritan Bitincka, and Ledion Bitincka. With an initial product (then called Cribl LogStream) offering a purpose-built engine for observability stream processing, Cribl aimed to address concerns around the increasing volume and related rising costs of telemetry data by providing an abstraction layer between data sources and destinations. Renamed Cribl Stream, this early offering in the observability pipeline space is now one of multiple Cribl products including Cribl Edge (2022), Cribl Search (2022), and Cribl Lake (2024).

Based out of San Francisco, the company is fully remote and is currently led by Sharp (CEO), D. Bitincka (CPO), L. Bitincka (CTO), Zach Johnson (CFO), Abby Strong (CMO), Lisa Neilsen (Chief People Officer), Matthew Kelly (Chief Legal Officer), Mike Pyle (CRO), and Myke Lyons (CISO).

The Cribl elevator pitch (per Cribl):

Cribl’s data engine gives IT and security teams choice and control over their data. Customers use Cribl’s vendor-agnostic solutions to analyze, collect, process, and route all IT and security data from any source or in any destination, delivering the choice, control, and flexibility required to adapt to their ever-changing needs. Cribl’s product suite, which is used by Fortune 1000 companies globally, is purpose-built for IT and Security, including Cribl Stream, the industry’s leading observability pipeline, Cribl Edge, an intelligent vendor-neutral agent, Cribl Search, the industry’s first search-in-place solution, and Cribl Lake, offering flexible low cost storage for telemetry data.

Size

- 800+ employees

- $700M+ in total funding:

- $4M seed round in February 2019

- $7.4M Series A in April 2020

- $35M Series B in October 2020 (Sequoia Capital, with participation from CRV)

- $200M Series C in August 2021 (led by Greylock and Redpoint Ventures)

- $150M Series D in May 2022 (led by Tiger Global Management)

- $319M Series E (at a $3.5B valuation) in August 2024 (led by Google Ventures)

- Customers in North America, EMEA, and ANZ; public logos include Accenture, Aflac, SAP, Transunion, and Vodafone. Per a recent press release: “The customer base has grown by triple digits YoY for five straight years, including a quarter of the Fortune 500 companies that are now Cribl customers.”

- Announced that it had hit $100M ARR in October 2023.

Product Information

Cribl Stream: Cribl’s flagship observability pipeline product. Vendor agnostic, Cribl Stream allows IT and security teams to collect, route, enrich, redact and replay MELT (metrics, events, logs, and traces) data, thereby giving them greater control over their data and the costs incurred by related tooling. Cribl Stream can be deployed on prem or managed via Cribl.Cloud, and sits at the heart of Cribl’s product portfolio.

Cribl Edge: vendor-agnostic telemetry collection agent. Edge potentially simplifies fleet management across different devices by reducing the number of different types of agents and centralizing where and how they are managed. Edge also offers automatic configuration, teleporting into Edge node instances, and dynamic process instrumentation.

Cribl Search: Cribl’s search-in-place solution for accessing telemetry data without moving it to centralized storage. Kusto Query Language (KQL) based, Cribl Search integrates with Cribl Stream and Edge, and currently supports a variety of data sources including object stores (e.g., AWS S3, Azure Blob Storage, Google Cloud Storage), data lakes (e.g. Cribl Lake, Amazon Security Lake, Amazon S3), data warehouses (e.g., Snowflake, ClickHouse), analytic services (e.g. Azure Data Explorer, Elasticsearch, OpenSearch), and API endpoints (e.g. Azure, AWS, Google Workspace, Okta, Zoom). Currently available only in Cribl.Cloud; notably, Cribl Search can be used both alongside and independently from other Cribl products.

Cribl Lake: Cribl’s in-house data lake solution for telemetry data, Lake offers easily managed retention and access control policies, and integrates with Cribl Stream, Edge, and Search. Currently available only in Cribl.Cloud

In addition, Cribl offers Cribl.Cloud for fully managed cloud-based access to Cribl products (available directly through Cribl or through AWS Marketplace) and Cribl Copilot (available throughout the Cribl product suite).

Go to Market

Cribl’s GTM includes a strong enterprise sales motion with support from a large number of channel partners. Cribl also reaches its current customers via its technical alliance partners (including Microsoft, Crowdstrike, Wiz, and Grafana) and managed security service providers. In January the company announced its startup program, “designed to build an ecosystem of next generation data companies focused on creating innovative solutions for IT and Security.”

On the practitioner adoption and enablement side, Cribl strives to support a PLG motion through a free Cribl Sandbox as well as a data-volume-limited free plan on Cribl.Cloud. Cribl University offers free training and certifications, with certifications for Cribl Certified User, Cribl Certified Admin, and Cribl Certified Admin – Edge. Currently boasting 6k+ certifications, it is worth noting that this represents an increase of 2k+ certifications in less than a year, as the company (and its goat mascot) celebrated the 4k certifications mark in January 2024.

It is also worth noting that Cribl has an enthusiastic user base and quirky company ethos (did I mention the goat mascot?), both of which are on full display at the company’s user conference, CriblCon.

Competitive Landscape

Observability costs have become a hot topic of late. Cribl operates in a space adjacent to logging, APM, and observability vendors, with the goal of helping customers optimize and better control the data sent to these vendors, ultimately resulting in cost savings for customers. (This also potentially cuts into the profits of said vendors, and if this sounds familiar to you, you may be remembering the much talked about lawsuit Splunk filed against Cribl in 2022; the case went to trial in 2024 and, among other outcomes, Splunk was awarded a grand total of $1 in damages). In response to concerns over observability costs, observability vendors like Chronosphere, Datadog, and Honeycomb have introduced observability/telemetry pipeline capabilities.

Cribl, however, sees DIY efforts (leveraging technologies such as Apache NiFi, Logstash, and occasionally Apache Kafka) as their primary competitor. As organizations deal with an increasing number of data sources and destinations, Cribl’s vendor agnostic offerings, product maturity, SaaS option (with its easy onramp), and support and service offerings (along with solid documentation and practitioner support) place it in a solid position to offer an appealing alternative to these DIY efforts.

Disclosure: Cribl is a RedMonk client, but this is an uncommissioned piece of research. AWS, Chronosphere, Cisco (Splunk), Elastic, Google Cloud, Honeycomb, and Microsoft are also RedMonk clients.

No Comments