TL; DR – All of the hyperscale cloud providers are green and are focused on becoming greener.

As a developer there are various aspects of product development that you can influence, and one of the key areas that has a longer-term impact on the entire business is your choice of cloud provider or data centre. While the straight up dollar cost is relatively easy to calculate, you can also factor two environmental questions – how green are your cloud providers and how are they influencing the longer-term make-up of the electricity grid.

The hyperscale cloud providers (Amazon, Google and Microsoft) have a significant level of influence when it comes to purchasing electricity. They can impact both public policy and commercial perspectives on how it is generated. The primary public manifestation of this influence is via Power Purchases Agreements (PPAs).

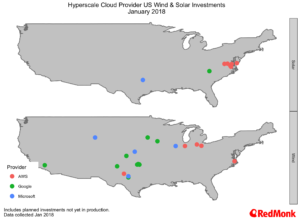

Over the last few years each of the hyperscale providers have made strategic use of PPAs in the US market. In a number of cases, such as in Virginia, North Carolina and Texas, this is having a direct impact on the make-up of the electricity grid. If Amazon, Google or Microsoft call, the electricity companies are listening.

Public Policy Statements

Each of the hyperscale providers have made public policy statements about their current energy consumption and long-term goals. Suffice to say the direction of travel in terms of renewable energy is positive for all of them.

| Provider | Current | Goal |

| AWS | 50% renewable energy for data centers in 2017 | 100% long term goal, no specific date |

| 100% renewable energy across data centers and offices (purchase offsets, includes non-public cloud) | – | |

| Microsoft | 100% Carbon Neutral | 44% from wind, solar or hydro, aiming for 50% this year, 60% early 2020s |

The sheer scale of the efforts of each of the providers is noteworthy, but Amazon deserves to be singled out – while their headline percentage is currently lower than the others, the focus on reaching 100% sustainable electricity, while still growing their business at current rates, is impressive.

Data Center Locations & Renewable Targets

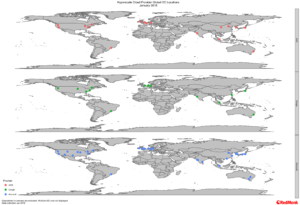

To understand the potential impact of the cloud providers on electricity demands and therefore the structure of the supply side networks, we need a clear picture of their primary locations worldwide.

It should be noted that the total number of locations does not imply wider availability. Microsoft is only beginning to roll out availability zones (AZ), whereas Amazon and Google have multiple AZs in each area indicated on the maps above. Microsoft have had a focus on geographic locality.

Outside of the US, the hyperscale providers are expanding in various regions, with clusters emerging in Canada, Ireland, Germany, United Kingdom, Benelux, India, China, South Korea, Japan and Australia. As noted above details on PPAs outside of the US are relatively limited, but we can look at the mix of renewables in each of the national power grids.

| Electricity Production & Targets | ||

| Country | Current % Renewables | Goal (2020 and beyond) |

| South Korea | 6% | 20% by 2030 |

| Ireland | 27.2% [2016] | 33% |

| Canada | 18.9% [2017] | No national target |

| United Kingdom | 30% [2017 Q3] | 30% |

| Germany | 32.2% [2016] | 35% by 2020 |

| China (mainland) | 25% [2016] | Hard to discern a specific target. |

| India | 18% | 20% by 2022 |

| Japan | 10% | 24% by 2030 – Japan is also reopening nuclear plants |

| Australia | 14% [2016] | 17% – Australia lowered its target from 20% in 2015 |

| Belgium | 15.8% [2016] | 21% |

| Netherlands | 12.5% [2016] | 37% |

Note: this table refers to electricity only; transport and heating significantly alter the numbers for total energy consumption in each country.

Direct Investment In & Purchase of Renewable Energy

As noted above, the hyperscale providers have been very public about their US investments in renewable and sustainable energy. Graphically, we can see specific geographic groupings, with Google focused on the mid-west, while Amazon are heavily weighted towards the east coast.

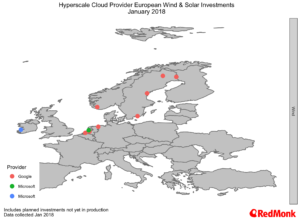

The European story is more complex due to the nature of the market, and data about the PPAs signed is harder to come by. The hyperscale providers, along with a number of other large power consumers, have recently asked for significantly more regulatory alignment across the EU for PPAs, as well as an EU-wide goal of having renewables provide 35% of all energy. Such alignment would make it easier for firms to make specific commitments to purchasing renewable energy, such as the recent Microsoft agreement in the Netherlands.

Elsewhere in the world there are no public investments in green energy listed, with the exception of Googles investment in Chilli, but we anticipate this will change as the providers engage further with local energy companies and regulators.

| Total Renewable Energy Purchases via PPAs – Jan 2018 | |

| AWS | 1150 MW |

| 2620 MW | |

| Microsoft | 759 MW |

Data Centre Efficiency Investments

Each of the hyperscale cloud providers is keen to highlight their work on data center efficiency, and in no way should this be taken lightly – there is significant ongoing research and investment across all of these companies towards making their data centers more efficient.

But make no mistake here, it is clearly of both strategic and business importance for Amazon, Microsoft and Google to invest significantly in this area – we would have far more questions to ask if they were not making such investments.

Conclusion

Most large enterprises will struggle both to run data centers as efficiently as the hyperscale providers and to leverage their data centers to influence public policy or the make-up of power grids.

If there are green criteria to your projects, considering one of the hyperscale providers will serve you well.

Disclosures: Amazon, Microsoft and Google are current RedMonk clients.

No Comments